Discover the smarter way to track your miles with TripLog, the #1 mileage tracker app

Mileage Tracker App by TripLog

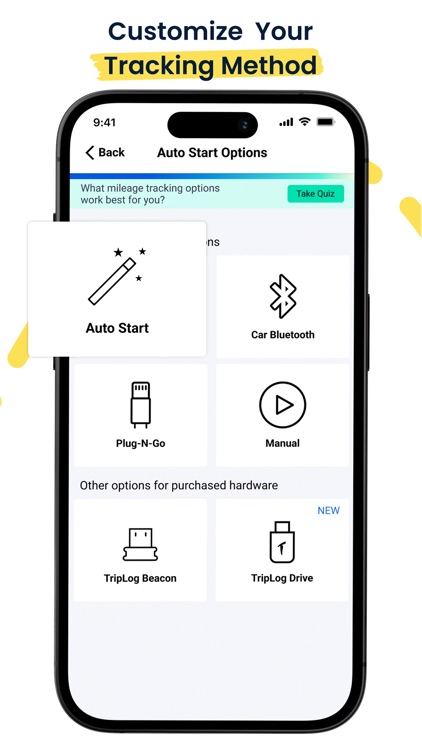

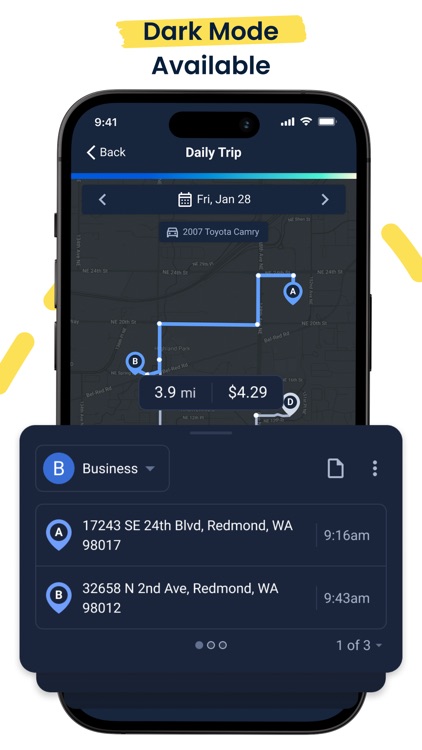

TripLog includes a lot of features similar to most of the apps in this category. It is nicely packaged and and there are a ton of in-app purchases so that you can tailor this app to your specific mile tracking needs.

Check the details on WatchAware

What is it about?

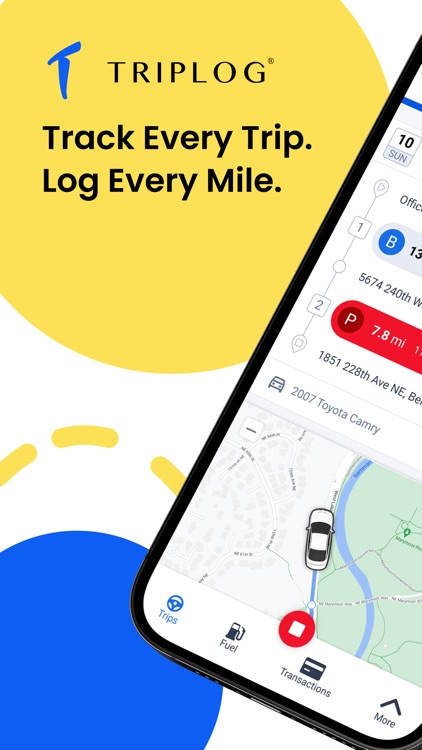

Discover the smarter way to track your miles with TripLog, the #1 mileage tracker app! Designed for gig workers, freelancers, and businesses of all sizes, TripLog saves you time, maximizes your tax deductions, and streamlines employee reimbursements through the power of automatic mileage tracking.

Mileage Tracker App by TripLog is FREE but there are more add-ons

-

$2.99

Cloud Storage

-

$4.99

Power User Package

-

$14.99

Bundled Package

-

$4.99

Executive Package

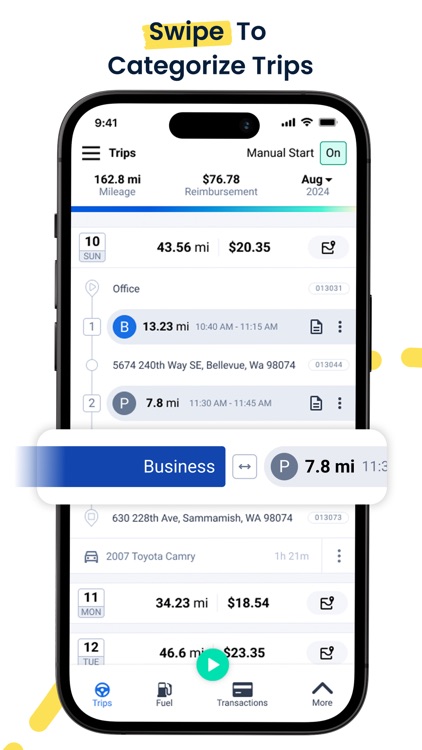

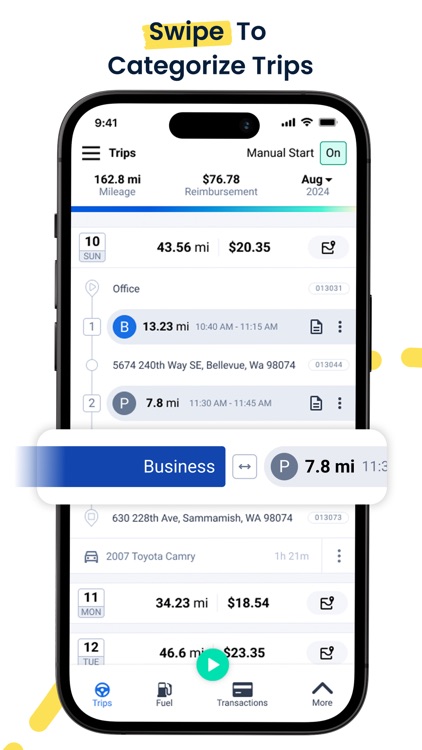

App Screenshots

App Store Description

Discover the smarter way to track your miles with TripLog, the #1 mileage tracker app! Designed for gig workers, freelancers, and businesses of all sizes, TripLog saves you time, maximizes your tax deductions, and streamlines employee reimbursements through the power of automatic mileage tracking.

► Key Features for Gig Workers & Freelancers

• Automatic mileage tracking: TripLog starts tracking when you start driving, and stops when you stop

• Smart expense tools: Easily separate personal and business expenses for optimal tax deductions

• Customizable, IRS-compliant reports: Generate reports in various formats (CSV, PDF) for tax filing

• Secure cloud storage: Access your mileage data anytime, anywhere, and never worry about losing your records

► Enterprise & Business Solutions

• Scalable and customizable: TripLog adapts to businesses of all sizes, from small teams to large enterprises

• Centralized management: Oversee employee mileage and expense reimbursement with our easy-to-use admin dashboard

• Configurable reimbursement policies: Set custom mileage rates and rules tailored to your organization's needs

• Seamless software integration: Connect TripLog with your favorite payroll tools for a streamlined workflow

► Why Choose TripLog?

• Trusted by thousands: Join our community of savvy drivers who trust TripLog for their accurate mileage tracking needs

• User-friendly design: TripLog’s intuitive best-in-class interface makes it easy to track, manage, and report your miles on your phone

• Exceptional support: Our dedicated, friendly team is always ready to help you succeed

Upgrade your mileage tracking experience with TripLog, the most reliable and efficient solution for gig workers, freelancers, and businesses. Download now and unlock the full potential of your tax deductions and reimbursements!

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.