Web version: https://apps

Value at Risk Calculator

What is it about?

Web version: https://apps.variskindo.com

App Screenshots

App Store Description

Web version: https://apps.variskindo.com

Main Features:

- Add the stocks and currency pairs of your choice

- 2-year historical data from Google Finance

- User-defined portfolio consisting stocks you have added

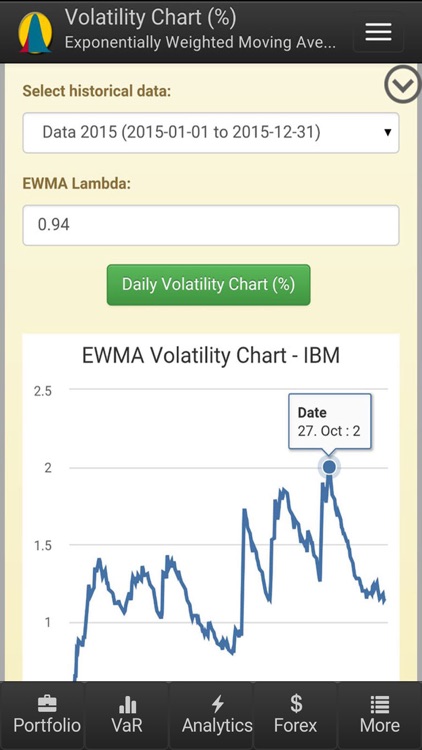

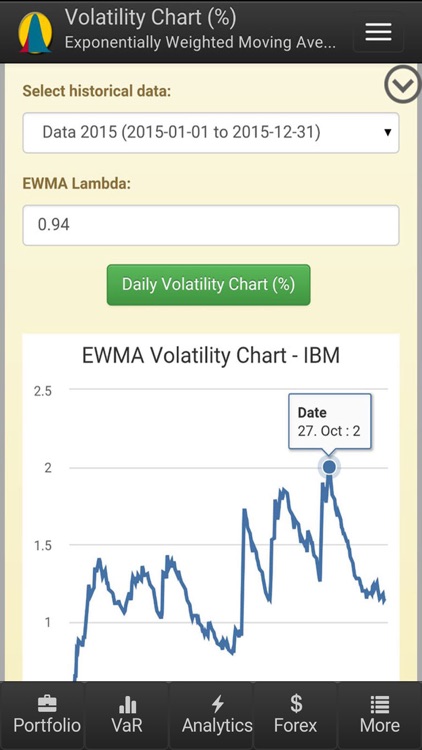

- View price chart, return chart and volatility chart using Exponentially Weighted Moving Average (EWMA)

- Monitor your portfolio market values, profit/loss, portfolio return, volatilities and VaR figures instantly

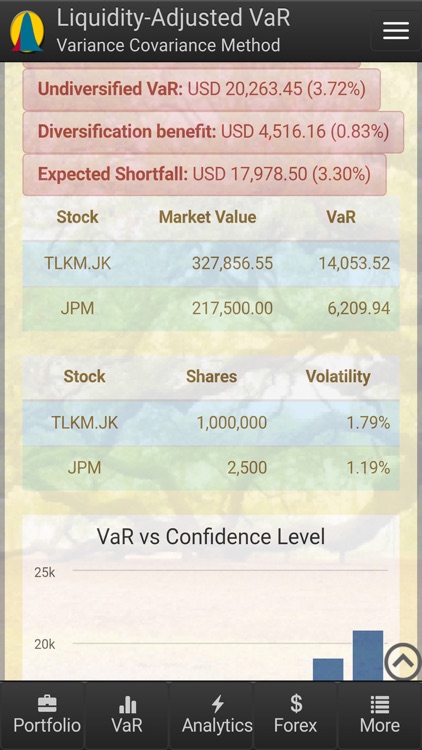

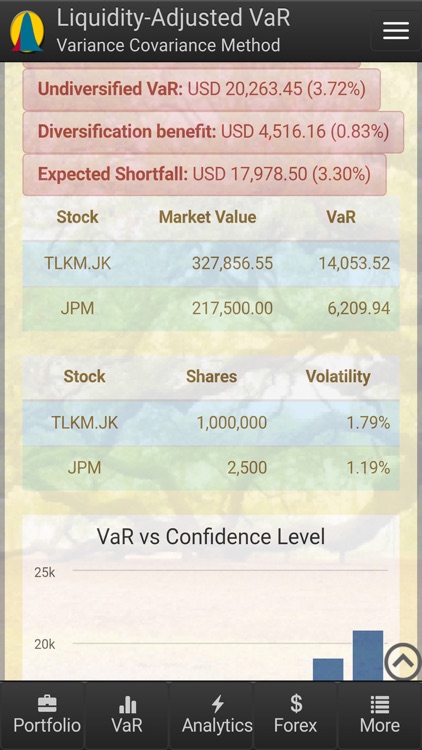

- Calculate Standard Normal z-score of Confidence Level, Market Value at Risk (VaR) and Expected Shortfall (ES) using Variance Covariance Method (VCM) based on the chosen confidence level and holding period

- Fitting a GARCH(1,1) model

- Calculate Liquidity-Adjusted Value at Risk (VaR) and Expected Shortfall (ES) based on bid-offer spread using VCM

- Estimate Credit Value at Risk (VaR) and Expected Shortfall (ES) using One-factor Gaussian Copula based on the chosen confidence level and copula correlation

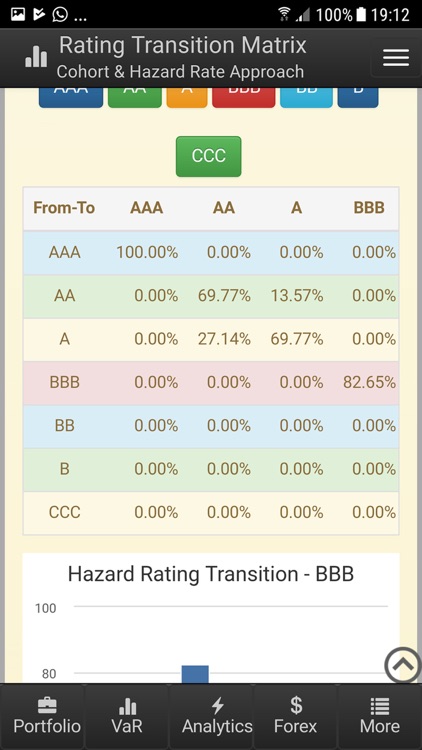

- Estimate Rating Transition Matrix with Cohort and Hazard Rate Approach

- Credit Scores with Logistic Regression

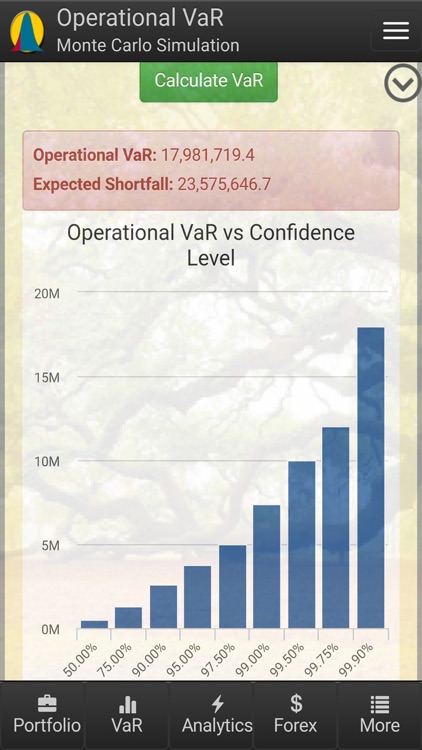

- Compute Operational Value at Risk (VaR) and Expected Shortfall (ES) using Monte Carlo Simulation based on Poisson and Log-Normal distribution

- Run R Scripts for online statistical data analysis

- Live Currency Rates & Gold Price

- Estimate Probability of Default (PD), Copula Correlation & Worst Case Default Rate (WCDR)

- Real-Time Global News

- Fitting of Lognormal Distribution

- Sign-in using Facebook, Twitter or email and password

- Offline Sign-in (email-password only)

Value-at-Risk (VaR) is a statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over a specific time frame. It estimates how much a set of investments might lose, given normal market conditions, in a set time period such as a day. VaR is measured in three variables: the amount of potential loss, the probability of that amount of loss, and the time frame and typically used by firms and regulators in the financial industry to gauge the amount of assets needed to cover possible losses.

Expected Shortfall is an alternative to Value-at-Risk that is more sensitive to the shape of the tail of the loss distribution. Expected Shortfall is also called Conditional Value-at-Risk (CVaR), Average Value-at-Risk (AVaR), and Expected Tail Loss (ETL).

By Liila Tech (Mobile Apps PT VaRiskindo)

Email: info@variskindo.com

Web: https://variskindo.xyz

Web: http://liila.xyz

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.