Could your business reduce its VAT liability by joining the Flat Rate Scheme

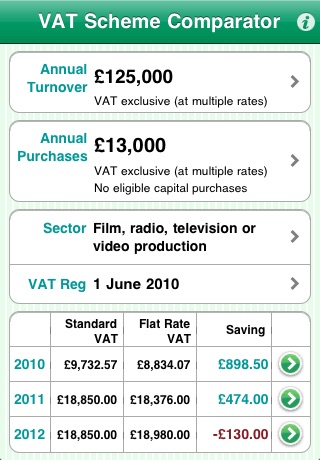

VAT Scheme Comparator

What is it about?

Could your business reduce its VAT liability by joining the Flat Rate Scheme?

App Screenshots

App Store Description

Could your business reduce its VAT liability by joining the Flat Rate Scheme?

Small businesses can generally reduce the VAT they pay by joining the HMRC Flat Rate Scheme, but it depends on your specific business circumstances.

Newly VAT registered businesses are eligible for an extra 1% discount in the first year (potentially £800-£1800 yearly saving)

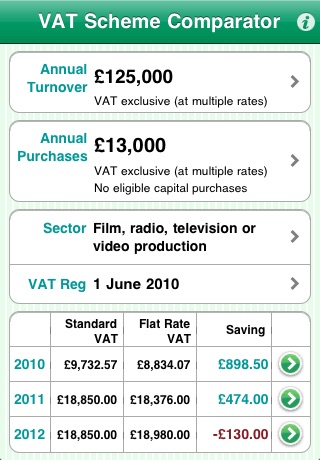

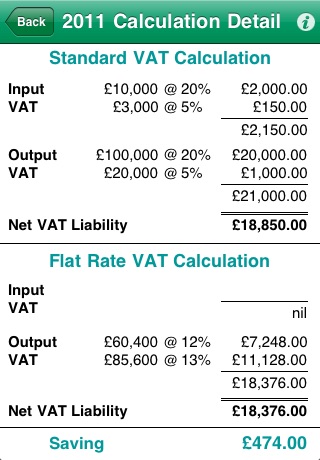

This is the only App which provides a detailed illustration of the VAT due over the next 3 years fully tailored for your business. The illustration shows both VAT due using standard VAT accounting and VAT due under the Flat Rate Scheme and highlights the difference.

For businesses already joining or in the Flat Rate Scheme, the App offers a comprehensive search facility to help identify the appropriate business sector and applicable flat-rate percentages for 2010 and 2011.

DETAILED FEATURES:

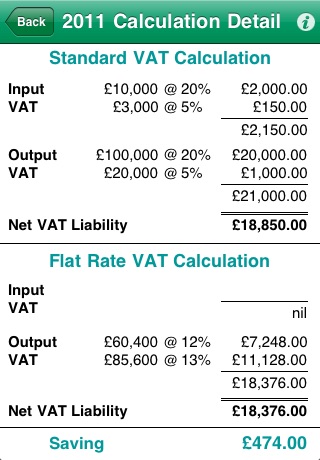

- Calculate and compare VAT due under the Flat Rate Scheme for 3 years based on your business turnover and expenditure

- Support for turnover at standard, reduced rates, zero-rated and exempt from VAT

- Support for expenditure at standard and reduced VAT rates

- Identify correct business sector and flat-rate percentages from fully-searchable list of over 400 trades and business activities

- All features of the Flat Rate Scheme supported including first year 1% discount and reclaiming VAT on Capital Purchases

- View the detailed calculation for each year

- Full support for VAT rate changes from 2011

- Integrated help guide

For details on the HMRC Flat Rate Scheme please refer to the HMRC website.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.