Vita Nova Hedge Fund us a regulated mutual fund that achieve long term capital growth by identifying short to medium term investment opportunities with inherent pricing weaknesses and the potential to improve over time

Vita Nova Hedge Fund

What is it about?

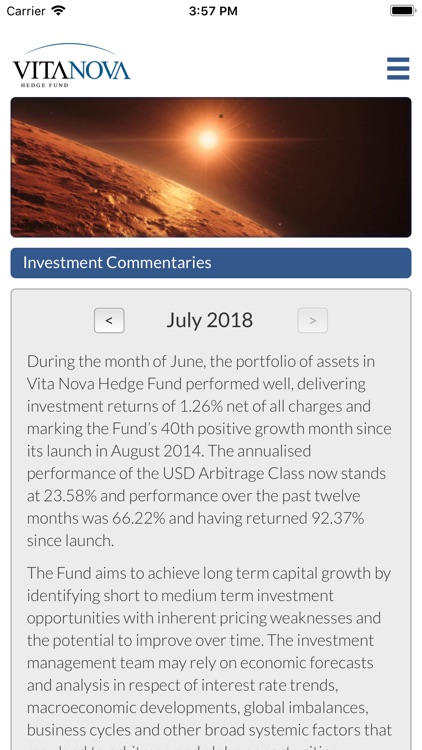

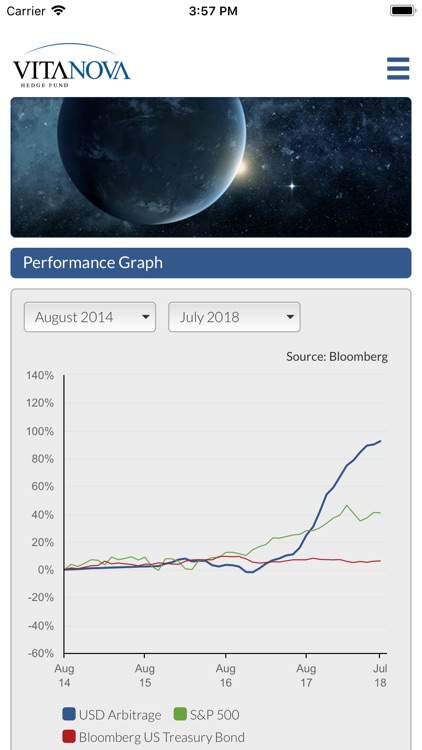

Vita Nova Hedge Fund us a regulated mutual fund that achieve long term capital growth by identifying short to medium term investment opportunities with inherent pricing weaknesses and the potential to improve over time.

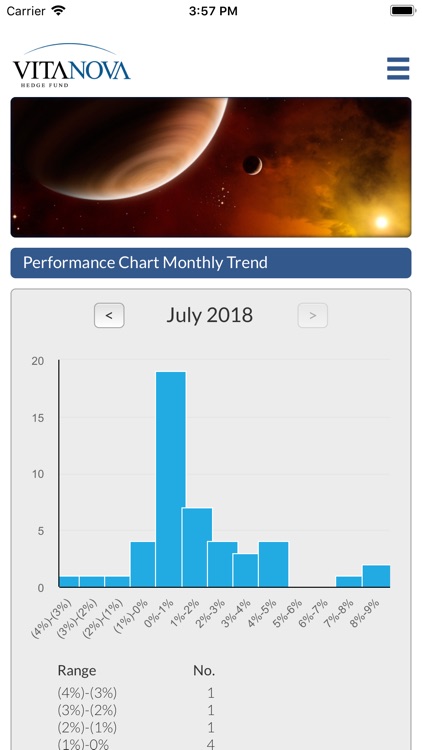

App Screenshots

App Store Description

Vita Nova Hedge Fund us a regulated mutual fund that achieve long term capital growth by identifying short to medium term investment opportunities with inherent pricing weaknesses and the potential to improve over time.

The fund's investment management team may rely on economics forecasts in respect of interest rate trends, macroeconomic developments, global imbalances, business cycles and other broad systemic factors to identify pricing weaknesses with the potential to strengthen over time.

Where the Manager identifies value opportunities it has the ability to use gearing to over invest wherever possible whilst preserving liquidity to afford relatively quick changes to the portfolio weighting and to take advantage of short term arbitrage and alpha opportunities.

VNHF may hold other investments including cash or near-cash assets, units or shares in other collective investment schemes, hosted securities and registered companies.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.