Our mobile-friendly solution allows users to trade stocks with more peace of mind, establish discipline, and take emotions out of trading

Watch My Risk

What is it about?

Our mobile-friendly solution allows users to trade stocks with more peace of mind, establish discipline, and take emotions out of trading.

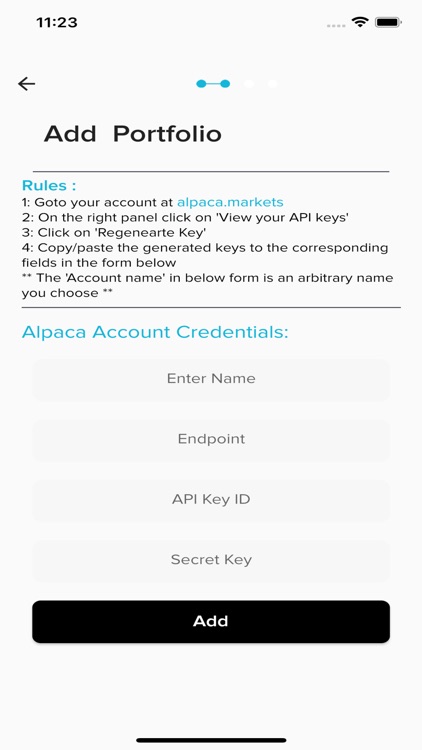

App Screenshots

App Store Description

Our mobile-friendly solution allows users to trade stocks with more peace of mind, establish discipline, and take emotions out of trading.

It provides users with a set of time-tested, pre-configured sell rules which can be beneficial to most equity investors.

In brief, Watch My Risk aka WMR allows users:

- To create stock portfolios manually and/or link their Alpaca brokerage account

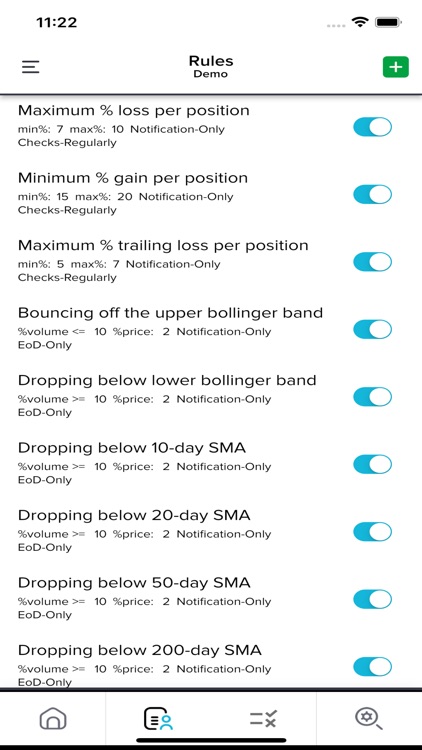

- Use a set of default exit/sell rules for each portfolio

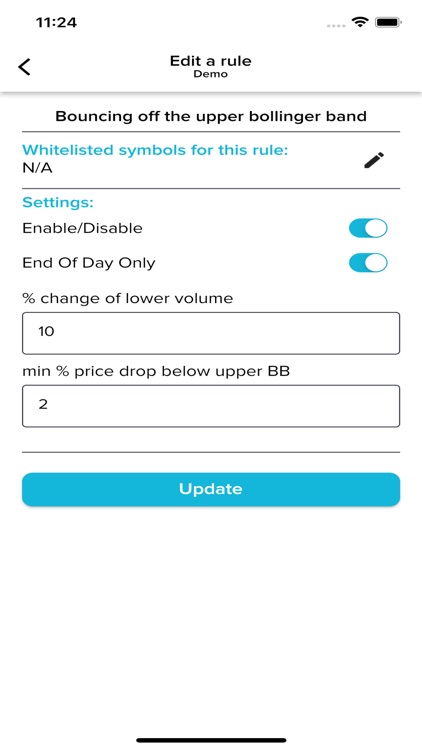

- To choose which rules to use and edit as well as activate/deactivate them

- To add part of their holdings to a whitelist so that Watch My Risk won't apply the rules to the holdings defined in it.

Trading accounts:

Currently we support Alpaca (www.alpaca.markets) for the linked brokerage accounts.

Alpaca allows users to create a paper trading account. This makes it ideal for testing our service and enables you to verify the provided trading rules and gain confidence in the configurations.

In addition, you may simply create a manual portfolio which will behave the same as a real account, except that you need to enter your holdings manually. The nice part of a manual portfolio is that you can spoof the purchase price to a value that forces a rule to be triggered. For example, if the price of a stock is $100 today, you may add that stock and say you bought it for $110. In this case, depending on your settings, a rule for 'Maximum loss per position' should trigger.

Rules:

Currently we support 12 of the most common sell rules. In the future, and based on users' feedback, we will be adding more rules.

Notifications:

For the linked accounts, you may choose to be notified only. In that case, upon triggering a rule, WMR won't place a sell order on your behalf.

End-of-day only:

User may choose to have rule(s) verified close to the end of a trading day.

Whitelists:

User may whitelist particular stocks per rule or globally. In that case, WMR won't apply rules to those whitelisted stocks. You can also whitelist only part of your holding. For example, assume you have 200 of Apple stock and want to keep 100 of them and only sell 100 if a sell rule gets triggered. In that case, you are able to whitelist only 100 of your Apple holdings.

For privacy statement, please refer to:

https://watchmyrisk.com/privacy

For Terms of Use, please refer to:

https://watchmyrisk.com/disclaimer

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.