- zWallet helps you manage your money follow a method named "JARS system" written by T

zWallet-JARS money management

What is it about?

- zWallet helps you manage your money follow a method named "JARS system" written by T.Harv Eker.

App Screenshots

App Store Description

- zWallet helps you manage your money follow a method named "JARS system" written by T.Harv Eker.

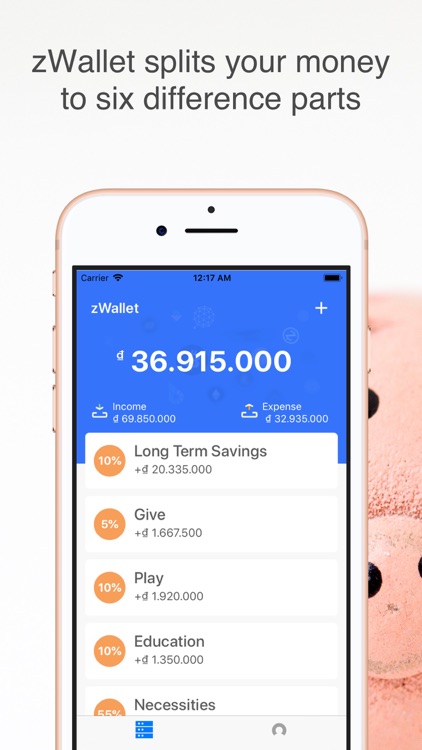

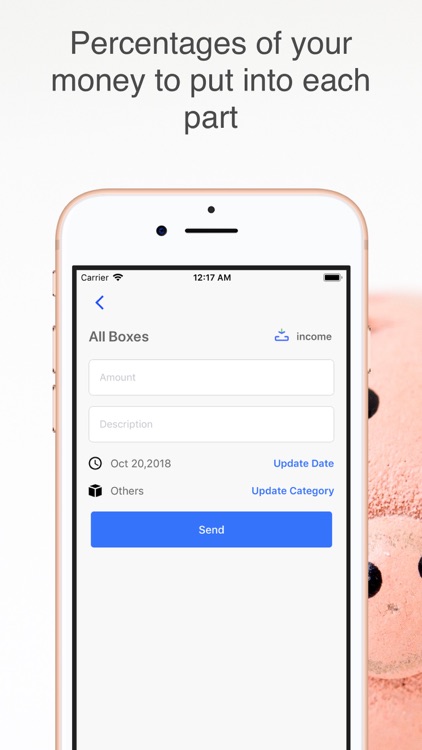

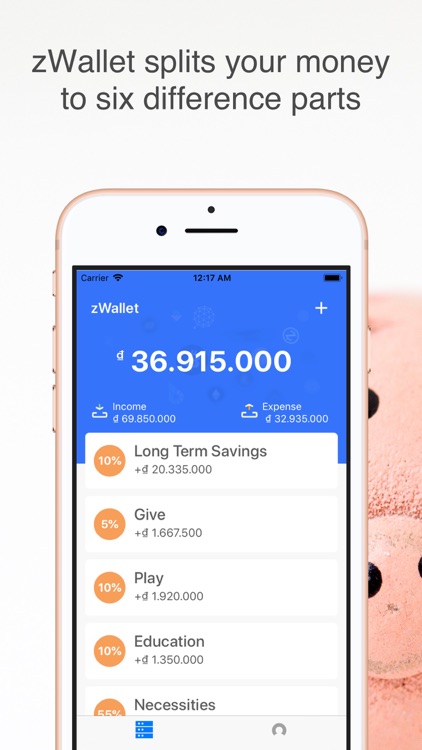

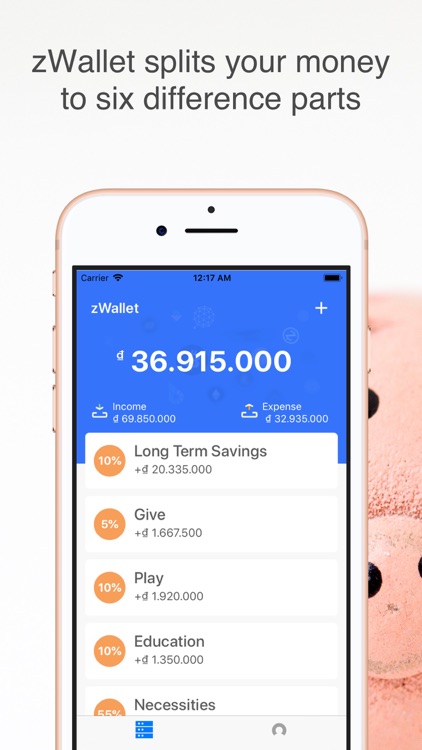

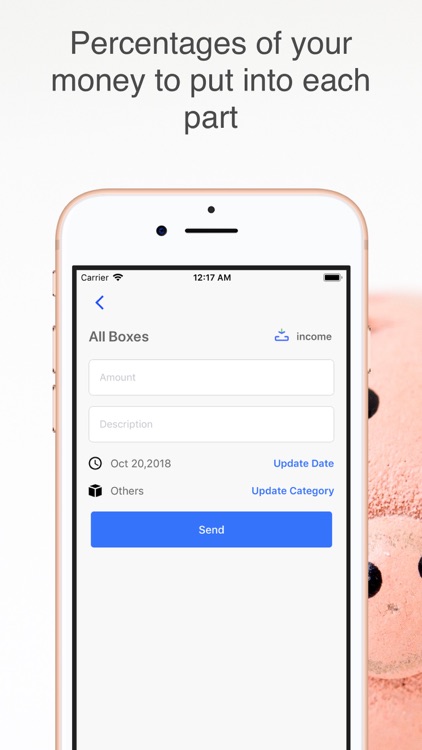

- Basically, zWallet splits your money to six difference parts, and you have percentages of your money to put into each part.

- Necessity Account (NEC - 55%):

This account is for managing your everyday expenses and bills.

This would include things like your rent, mortgage, utilities, bills, taxes,

food, clothes, etc. Basically it includes anything that you need

to live, the necessities.

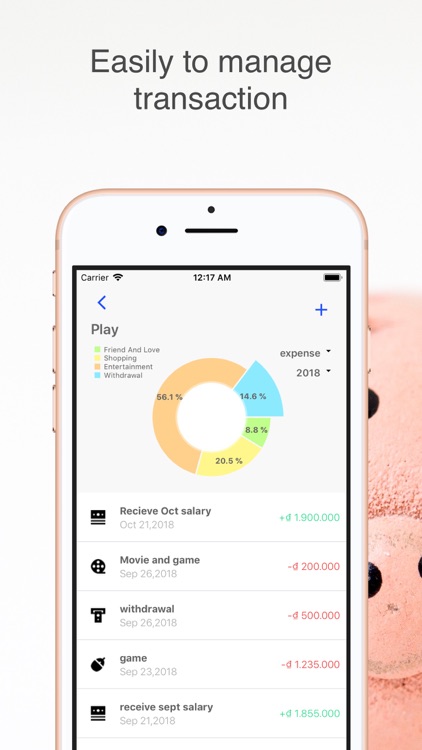

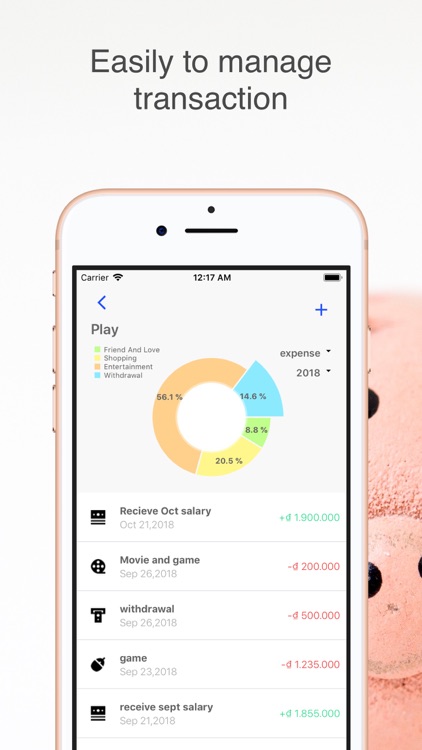

- Play Account (PLY - 10%):

PLAY money is spent every month on purchases you wouldn’t normally

make. The purpose of this jar is to nurture yourself. You could purchase

an expensive bottle of wine at dinner, get a massage or go on a

weekend getaway. Play can be anything your heart desires. You and a

spouse can each receive your own play money, and not even ask what

the other person spends it on!

- Financial Freedom Account (FFA - 10%):

This is your golden goose. This jar is your ticket to financial freedom.

The money that you put into this jar is used for investments and building

your passive income streams. You never spend this money.

The only time you would spend this money is once you become financially

free. Even then you would only spend the returns on your investment.

Never spend the principal.

- Education Account (EDU - 10%):

Money in this jar is meant to further your education and personal

growth. An investment in yourself is a great way to use your money.

You are your most valuable asset. Never forget this.

Education money can be used to purchase books, CD’s, courses or

anything else that has educational value.

- Long-term saving for spending Account (LTS - 10%):

Money in this jar is for bigger, nice-to-have purchases. Use the money

for vacations, extravagances, a plasma TV, contingency fund, your

children's education etc. A small monthly contribution can go a long

way. You may have more than one LTS jar. If you have more than one

LTS, divide the 10% between the jars according to your priorities.

- Give Account (GIV - 5%):

Money in this jar is for giving away. Use the money for family and

friends on birthdays, special occasions and holidays. You can also give

away your time as opposed to giving away money. You could house sit

for a neighbor, take a friend’s dog for a walk or volunteer in your

community or for your favorite charity.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.