Fahrtenbuch

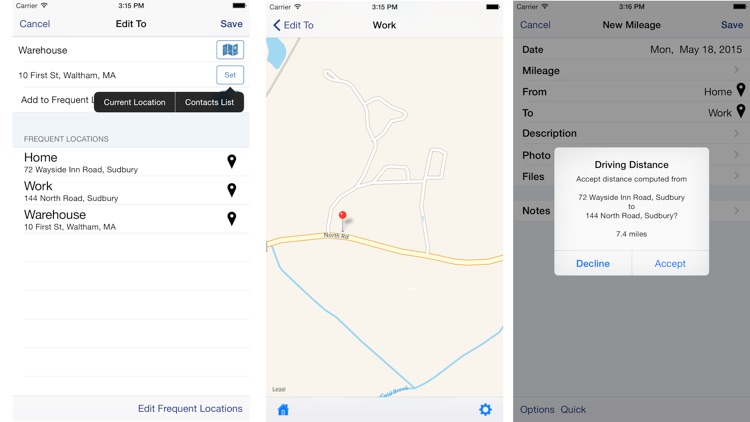

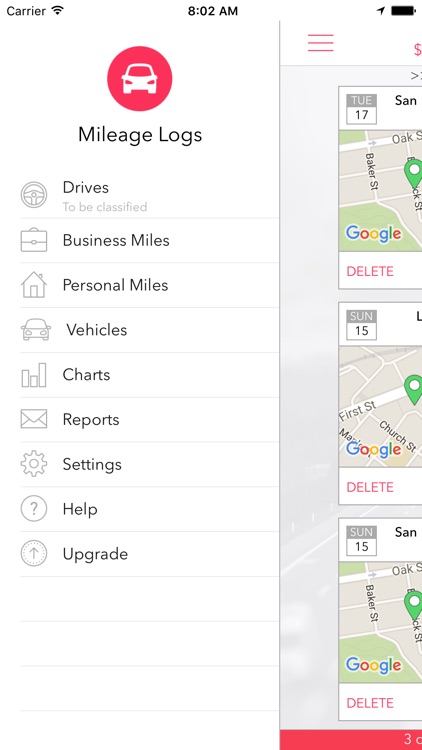

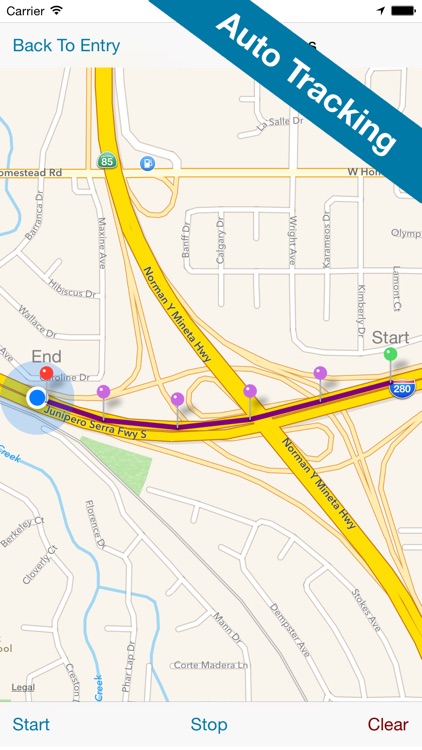

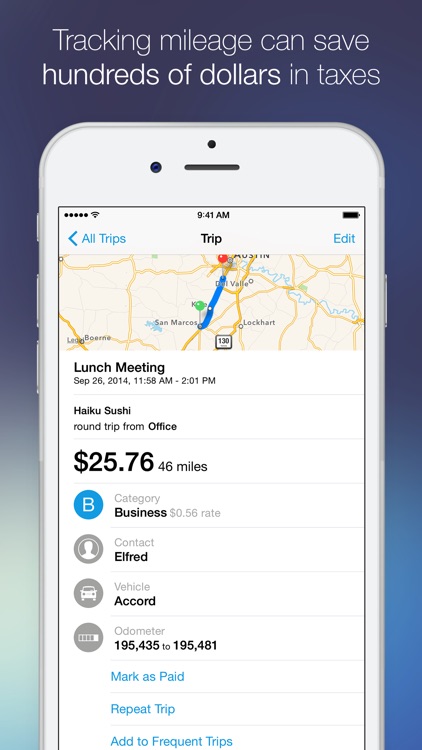

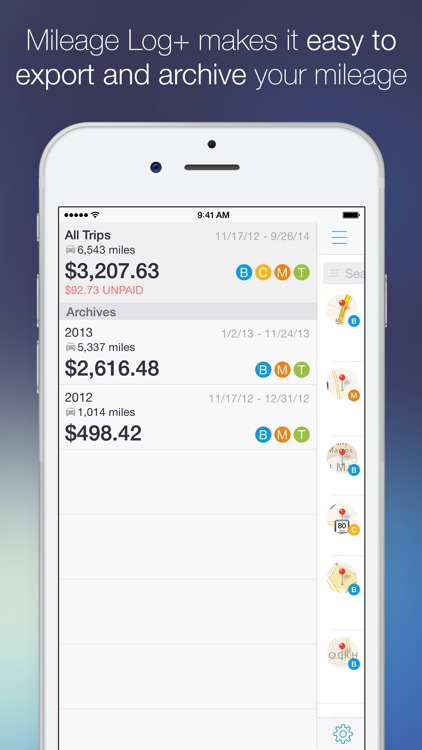

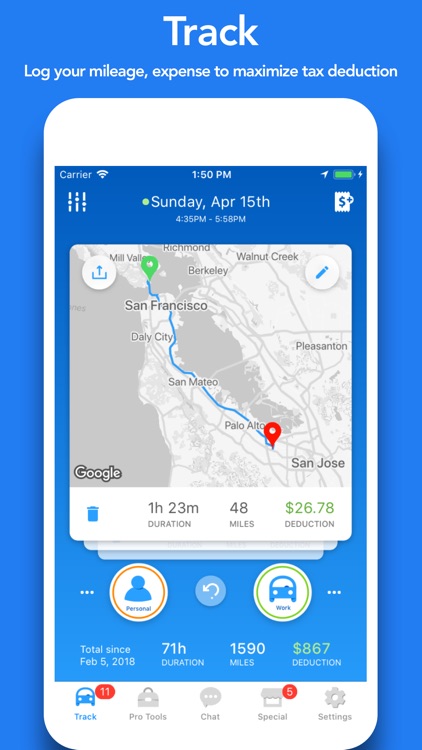

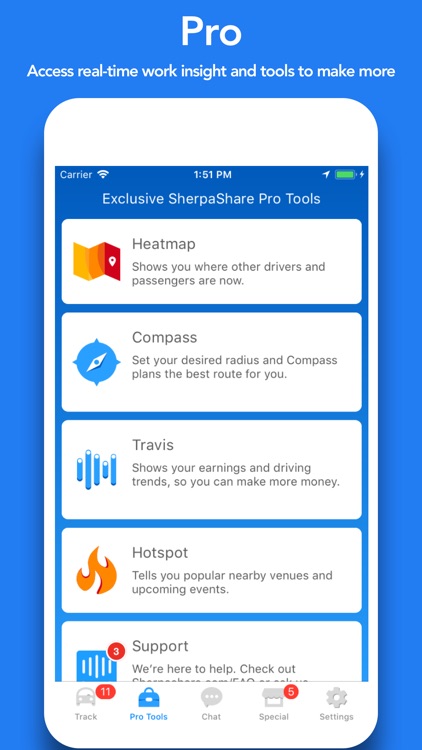

The first Mileage Log with CarPlay, GPS Tracking, Autostart | Autostop, iCal, Apple Watch, 3D Touch, Today-Widget, iBeacon, iCloud Backup, Touch ID, GoBD Export and Dropbox integration!

No registration, no recurring fees, no other hardware (OBDII dongle, etc.) needed!

Fahrtenbuch, is the #1 choice "drivers log" in germany, essential for anyone who...