Savings Goals Pro

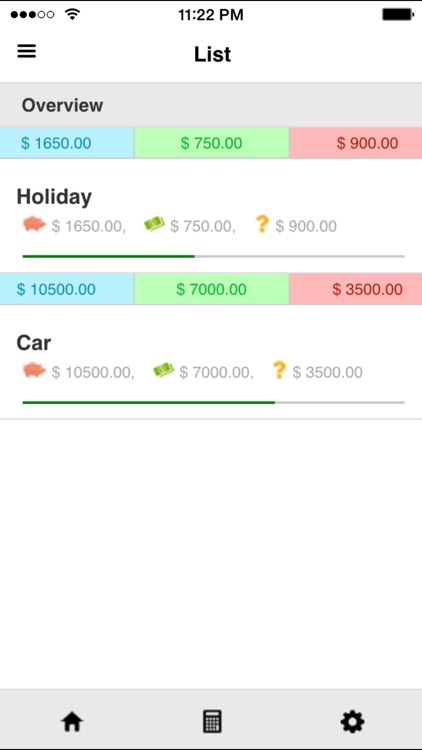

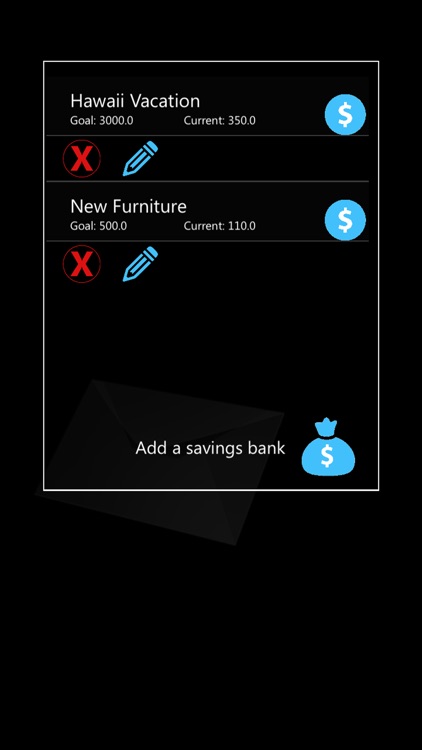

Savings Goals lets you enter a target amount and date and then suggests a savings schedule. Create multiple savings goals, easily view your progress, and customize the app with themes.

Highest scored apps in the category

Digit is an effortless way to save money without thinking about it.

Digit checks your spending habits and saves a few dollars from your checking account if you can afford it.

Save for the things you want the simple way.

With Qapital, do something, go somewhere, pay off your debts, or just save money with goals you create. Then attach a rule for each goal to help you save such as putting away a specific amount every week. Attach your bank account or a funding account and watch the money you save for your goals roll in.

Investing was for the wealthy. Now it's for everyone!

Acorns helps you save and invest small amounts regularly into your own diversified portfolio. Start with just your spare change and join over 1 million who have taken steps to improve their future.

Set your money goals and track your personal savings with this app

With Money Box, you can add a photo of what you are saving for and lets you easily manage your savings targets. The app has an intuitive interface, helping you to reach those savings goals.

Apps with average score

Savings Goals lets you enter a target amount and date and then suggests a savings schedule. Create multiple savings goals, easily view your progress, and customize the app with themes.

M1: Sophisticated wealth-building, simplified.

Meet M1: The Finance Super App®, where you can earn, invest and borrow—all in one place. Join hundreds of thousands of investors who trust us with more than $10 billion in assets.

EARN

• Optimize cash with our High-Yield Cash Account offering 4.00% APY1

• FDIC-insured up to $4.75 million2

•...

Are you saving for a house deposit, new car, holiday, household bill etc or putting money aside just in case?

Get 'Savings Goals' and track your progress when saving. You enter a target amount and an optional target date by which you want to save this amount and the app...

Take control of your focused savings plan and put the power to purchase what you want into the palm

Money Box is the only tool you need to set, manage, and achieve your saving goals so you can make payments or purchase the things that you want.

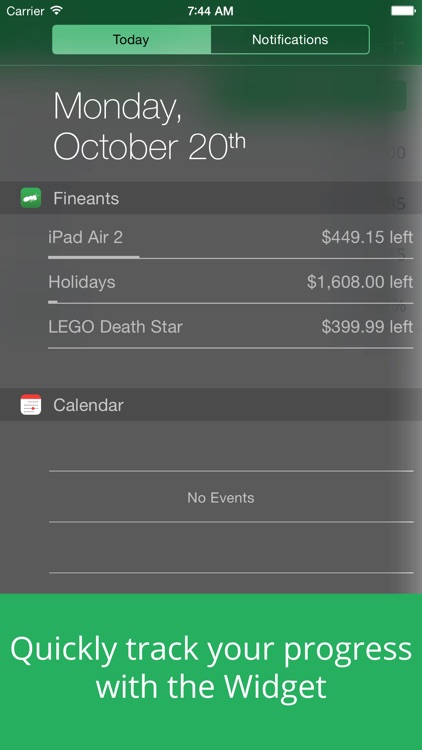

Save money little by little like ants do!

Fineants is gonna be your new saving assistant. Set a saving goal, log your savings, track your progress. You'll save money faster then ever with fineants!

**The ants saving model**

Every day there are many little things that you can do to save money, like...

Qoins is designed to help you pay off your debt and save money faster. Simply choose your financial goal, how you want to save, link your bank account, and we’ll take care of the rest!

Become debt-free, without even thinking about it! Qoins is your personal debt manager that helps you...

Welcome to your personal fundraising thermometer, where you can track what you save and reach your saving goals. Saving up has never been easier!

It's always better to save up for the things you want than spending money you don't have, and there's no better way to save than with a...

If you did something cool today, give yourself a tip.

For a neat way to save, Tip Yourself - Save Money, Build Habits lets you reward yourself. Whether you worked out, ate something healthy, finished a chore, or just had a great day, you can give yourself a tip for it. Connect your bank account and transfer money to it...

* Keep track of the amount you have contributed towards your savings goal

* or Record the amount of money you save in your piggy bank

* or use it to help you stay within budget when shopping

* View statistics on your savings progress (such as percentage)

* Customise the background colour to...

At Moneybox, we want to give everyone the means to get more out of life.

• Open a competitive Cash ISA

• Save for your first home with our market-leading Lifetime ISA

• Start investing in our range of funds, ETFs, and stocks

• Find and combine old pensions and build your retirement fund

All...

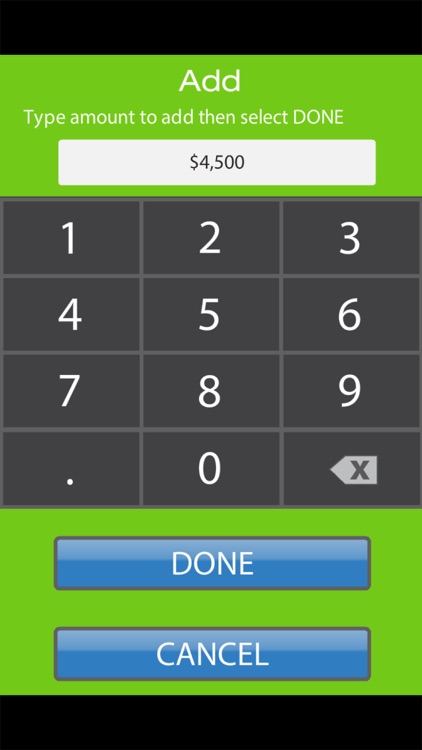

With Apscade Saver 2: Track multiple savings goals!

* Keep track of the amount you have contributed towards three savings goals

* or Record the amount of money you save in your piggy bank, sock or bank account

* or use it to help you stay within budget when shopping

* View statistics on...

Trouble reminding how much money you've already saved or missing notes with the amount? Don't panic! This PiggyBank app will allow you to maintain howmuch you have saved so far extremely easy!

This way you can easily:

- Maintain important details about your PiggyBank

- Add or remove money from the...

Raiz helps you easily save and invest your money. Get started in minutes with as little as $5, invest your spare change into a diversified portfolio with automatic round-ups, and give your money a chance to grow in the background of life.

Featured in: Forbes, WIRED, Bloomberg BusinessWeek, Business Insider, CNBC,...

Chip is here to make your life wealthy — we offer one simple, personalised experience to manage, grow and protect your wealth. That’s why we’ve been crowned ‘Best Personal Finance App’ in 2025, 2024, 2022, 2019 at the British Bank Awards.

* Start investing from £1 with our simple range of...

The simplest and most convenient way to reach your financial goals.

Simply Save App from Nippon India Mutual Fund gives you one of the easiest and simplest ways to invest in Mutual Funds.

Key Features:

Simply Save: Click on the ‘Simply Save’ button each time you want to save or invest....

iBillionaire is a secure investing app that helps you make simple and smart decisions with your money. It’s the first investment app where anyone in the world can invest in the U.S. stock market using just a debit card.

Buy stocks, ETFs, strategies, billionaire portfolios & more

Invest with as little as...

Thomaston Savings Bank Mobile Banking

With Thomaston Savings Bank Mobile Banking, you can easily take your banking with you. Access your accounts anywhere, anytime from your mobile phone. Our Mobile Banking App is convenient, fast, and free!

Thomaston Savings Bank Mobile Banking App allows you to do your banking on the go,...

HOW IT WORKS

- Download the app, create an account and securely link your bank

- Deposit money into your new Long Game account; nbkc bank, FDIC insured

- Use your Long Game card for everyday spending and get chances to play games

- The games are fun and easy and free, with chances...

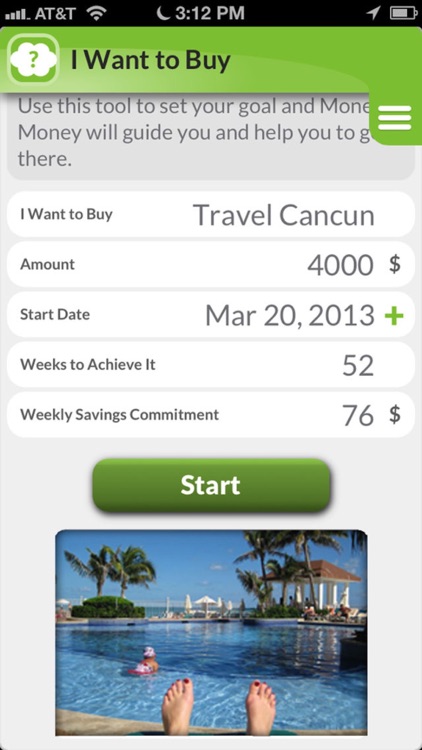

***** Reach any material goal!! *****

· Set up a coaching plan and Plus Money money will guide you until you reach your goals.

· An innovative and groundbreaking app concept.

· More than just a financial management app! DOWNLOAD NOW!

Plus Money money launches the first “I want to buy” app coaching plan....

**How can you save thousands a year?**

The maths is simple: In a 52 week year you will work 48 weeks on average.

If you spend $10 a day on lunch your average weekly spend is $50, over a year that adds up to $2,400. $15 a day adds up to $3600...

BoostUp: Save for Big Purchases

"A Savings App that Actually Pays"

SAVE FASTER FOR LIFE'S BIGGEST PURCHASES

BoostUp helps you save faster for your most important purchases, including new cars, new homes, vacations or weddings (Is there a wedding use case?). With our simple and FREE app, you can start saving with...

I Save! provides a simple and fun way for kids to record and track their money. It provides easy to use controls to categorize the money that they save and spend.

I Save! is designed for kids that are not old enough to hold on to their own money but are...

Automate your savings!

GoSherpy is the new app for saving money towards your dream goals.

It’s the app that makes it easy and effortless to save for the things you really want:

while you’re dreaming and planning we’ll be doing all behind the scenes work to make your goals happen....

Easy Savings is an easy to use money planning app for everyday use. Make saving your money a regular priority and with our easy to use goal orientated finance planning app you can make saving your money a very simple task.

Make Saving Money Simple with the Easy Savings - Money...

Could be good for special cases

Every time you give up something you save money to do something else!

With Oink saving is a game and you transform your dreams in goal!

- Oink is the app that helps you to process all your wishes and dreams in your goal!

- You'll be able to manage your savings in piggy bank.

- You'll be able to check your progress and create new goals and share your savings on different goal.

- With Oink give up something is easy and fun!

Monefy Is the easiest way to save money. Monefy tracks your expenses and were are you investing or not investing your money. Monefy will help you on having more control on your budgets and making sure your money is kept on the right place. Your pocket!

Planning a holiday or vacation? Want to save up for something special? With SaveUP you can set your goal or budget and track your progress.

FEATURES

* Multiple currencies available including: $,€,£ and more!

* Simple to use, quick andy beautiful designed.

* See you progress meter expand as you track your savings.

* See a list of all your entries, see how much you have saved and when each entry was made.

* Made a mistake? You can delete entries from within the list view.