Taxfyle: Taxes Done For You

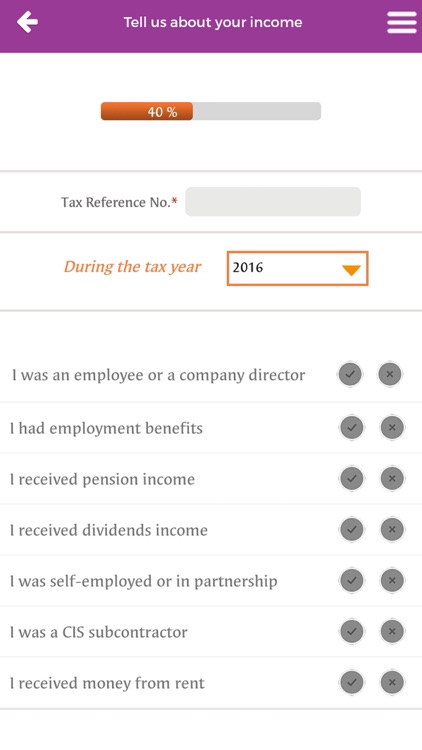

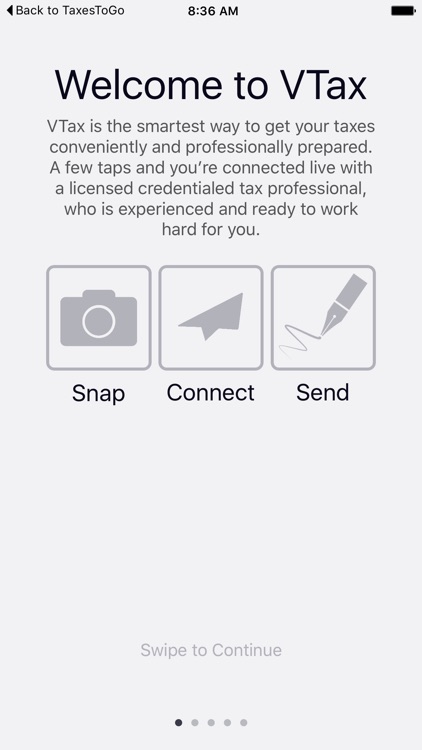

Professionally prepared income taxes done for you. Taxfyle assesses your tax position to automatically match you to a credentialed tax professional specializing in your tax position within seconds.

Most people find tax filing time consuming, overly complicated and/or expensive. Taxfyle is here to remedy these problems. The tax app allows you to upload documents via photos and the cloud. From there your tax pro will take care of the rest and in app message you if there are any questions.

With Taxfyle you can also confidently file your taxes knowing that your information is secure. Our in app messaging and data sharing is encrypted at rest and in transit. Also, we will never share your information without your consent.

Taxfyle only works with credentialed tax professionals to file your taxes. These are people like enrolled IRS agents (EA) or licensed certified public accountants (CPA). The average tax pro on Taxfyle has 14 years of experience so you can rest assured that you’re receiving the highest quality tax service.

How about after tax season? After tax season you’ll have access to all your documents year round. Applying for a mortgage? No worries, open up the app and email your tax return directly from the Taxfyle app. No more requesting and paying for previous year tax returns. At Taxfyle we also believe in free tax advice, so if you ever have a question just log in, click the help button and chat away 24/7. We’ll make sure to help you out.

Don’t take our word for it:

“Taxfyle is designed to be dead simple”

- Business Insider

“In just a minute, you can be connected to your own accountant”

- Macworld

“The secure tax filing app for millennials”

- Yahoo Finance

“Built to make your tax filing process easier”

- Fiverr

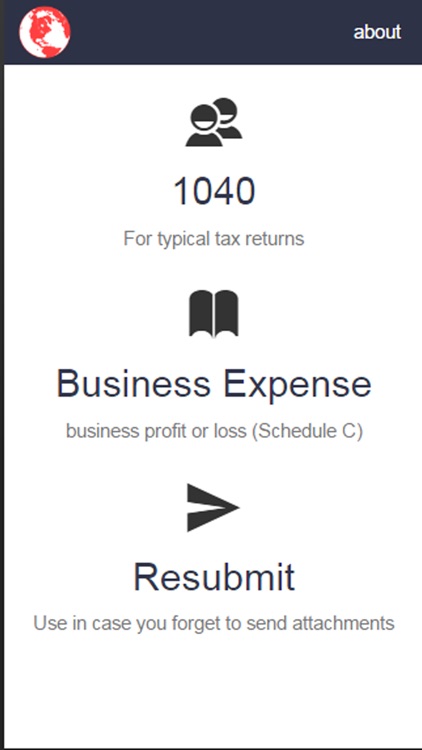

Taxfyle now prepares all business forms: Corporate (C Corp) Form1120, S Corporation (S Corp) Form 1120S, Partnership (LLP or LP or GP) Form 1065, Non-Profit Corporation (Form 990)

We’ve also added some more personal forms: non-resident alien (Form 1040-NR), expatriate or expat or someone living abroad.

Taxfyle is designed with you in mind. If you meet one of the criteria, Taxfyle is here to save you time and headache:

- Own a home

- Independent contractor / freelancer / business owner / Uber driver / Airbnb host / courier

- Own rental property or receive rent income

- Receive a K-1

- Sold stocks or investments

- Received dividends

- Own a foreign bank account or investment

If you own a business, you may want to use Taxfyle if you meet one of the criteria:

- If your business is an LLC, Sole proprietor, Corporation, Partnership, S Corporation, Not-for-profit

- Revenue is between $0 - $20M

- Make a profit or loss

- Maintain inventory

- Sales of business or capital assets

- You have partners or shareholders and you make a distribution or contribution

- You have a foreign parent or investors, or your business is an owner in a foreign company or partnership

- Engaged in rental real estate

- Use accounting software (Quickbooks, Xero, Shoeboxed, Expensify, Mint) to track your books (bookkeeping / record keeping). Or use excel to track income expenses.

- May qualify for tax credits