Investing was for the wealthy. Now it's for everyone!

Acorns: Invest For Your Future

Acorns helps you save and invest small amounts regularly into your own diversified portfolio. Start with just your spare change and join over 1 million who have taken steps to improve their future.

What is it about?

Acorns helps you save and invest small amounts regularly into your own diversified portfolio. Start with just your spare change and join over 1 million who have taken steps to improve their future. Painlessly invest your spare change into a diversified portfolio of ETFs of over 7,000 stocks and bonds automatically. Easily invest more - with Recurring Investments (daily/weekly/monthly), One-Time Investments, Referrals, and Found Money. Watch your progress – check in on your account from anywhere. SIPC Protected – up to $500,000 is protected against fraud so your money is secure. Stay educated – Gain access to our online personal finance publication, Grow Magazine. Withdraw anytime – at no charge.

Acorns has stickers

Acorns supports Siri commands

App Screenshots

App Store Description

Acorns helps you save, invest, and grow for your future. Our automated saving, investing, and spending tools help you grow your money and your financial wellness.

At Acorns, we believe that financial wellness is for everybody. It has nothing to do with how much you make — it’s about finding balance with what you have. Financial wellness is when you are spending smarter today, saving for tomorrow, and investing for your future all at once.

More than 13,000,000 Americans have invested over $22,000,000,000 with Acorns. You can get started in under 5 minutes, with as little as your spare change.

SECURE: Acorns is committed to your security with 2-factor authentication, fraud protection, 256-bit data encryption, and all-digital card lock. Acorns Investment accounts are SIPC-protected up to $500,000, and Acorns checking accounts are FDIC-insured up to $250,000.

WHAT’S IN THE APP:

INVEST:

- EASY, AUTOMATED INVESTING

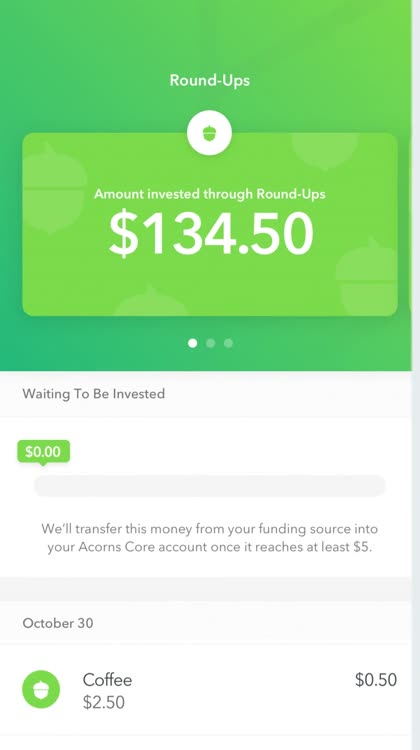

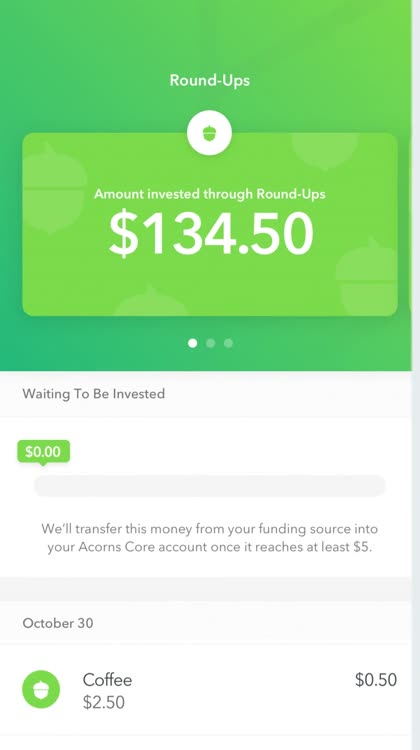

Your money is automatically invested into one of our diversified, ETF* portfolios, built by experts and recommended for you. You can invest spare change each time you make a purchase with Round-Ups®, or set up automated recurring investments starting as low as $5.

- PERSONALIZE YOUR PORTFOLIO

Personalize your investments with a Custom Portfolio, allowing you to add individual stocks from the largest 100+ public US companies.

- INVEST FOR RETIREMENT

Save for the future with an Acorns Later retirement account, and get a 3% IRA match on new contributions with the Acorns Gold plan.

- INVEST FOR YOUR KIDS

Start building your kids’ futures with Acorns Early, a dedicated investment account for your kids. Plus, we’ll match your investments by 1%!

SAVE:

- EMERGENCY FUND

Build savings for life’s unexpected hiccups, including a 4.52% APY** to help your money grow.

- CHECKING WITH APY

Earn 3.00% on your checking account with the Mighty Oak debit card.

AND MORE:

- KIDS & TEEN DEBIT CARD

Teach your kids financial wellness with a GoHenry debit card, included in the Acorns Gold plan.

- EARN BONUS INVESTMENTS

Shop 15,000+ brands and receive bonus investments and exclusive deals from your favorite brands. Plus, earn limited-time referral bonuses of up to $1,200.

- GROW YOUR MONEY KNOWLEDGE

Access custom articles, videos, courses, and live Q&As to learn about investment and savings strategies.

SUBSCRIPTION PLANS

Whether you’re new to investing or planning for your family’s future, we bundle our money tools into subscription plans. No hidden costs or transaction fees — just one, transparent monthly payment to start growing your oak.

Acorns Bronze ($3/mo)

——————

Investing tools to get you started on your financial journey, including:

- Round-Ups®

- Expert-built diversified portfolio

- Retirement account

- Checking account, and more

Acorns Silver ($6/mo)

——————

Level up your saving and investing skills, including:

- Everything in Acorns Bronze

- 1% IRA match on new contributions to your Acorns Later retirement account

- Emergency fund

- Courses and videos to help you grow your money knowledge

- Live Q&As with investing experts

Acorns Gold ($12/mo)

——————

Full suite of saving, investing, and learning tools for you and your family, including:

- Everything in Acorns Silver

- 3% IRA match on new contributions to your Acorns Later retirement account

- Investment accounts for your kids with a 1% match

- GoHenry debit card and learning app for kids

- Ability to add individual stocks to your portfolio

- $10,000 life insurance policy

- Complimentary Will, and more

————————

Finance Terms Definitions:

*ETF (Exchange-Traded Fund) = collection of investments, made up of pieces of various stocks, bonds, or other assets.

**APY (Annual Percentage Yield) = tells you the amount of interest you can earn from the money you have in a bank account in a year.

————————

Disclosures are available in the images above and at www.acorns.com/disclosures

5300 California Ave Irvine CA 92617

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.