M1: Where sophisticated wealth-building meets simplicity.

Your all-in-one platform for earning, investing, spending, and borrowing.

Join hundreds of thousands of investors who trust us with over $9B in assets.

EARN

Earn 5.00% APY1 on money in your High-Yield Cash Account. Set your own rules and automate money moves with Smart Transfers.

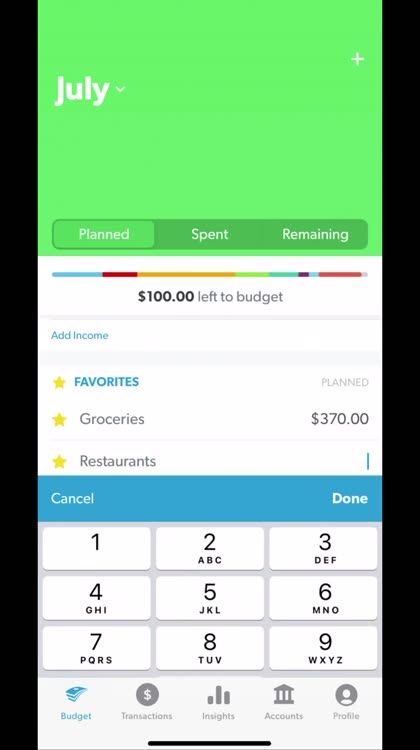

INVEST

Automate your long-term strategy when you invest with an individual, joint, trust, or custodial account. Or open a Traditional, SEP, or Roth IRA or rollover a 401(k).

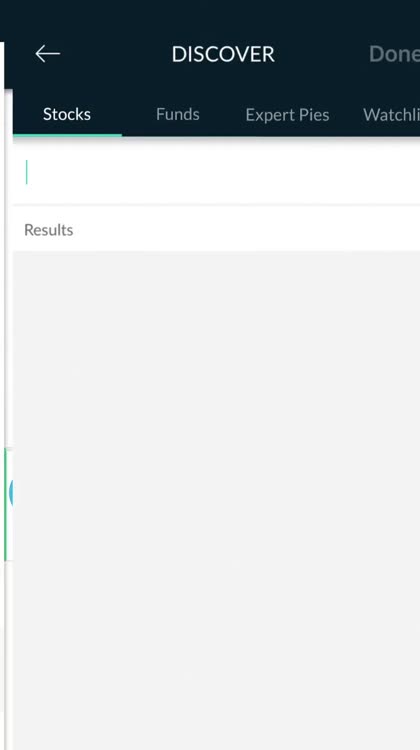

Build a custom portfolio with over 6,000 stocks and ETFs. Choose from pre-made Model Portfolios based on common strategies, so you can easily invest according to your values, risk tolerance, retirement plan, and more. Auto-invest over time for your long-term strategy.

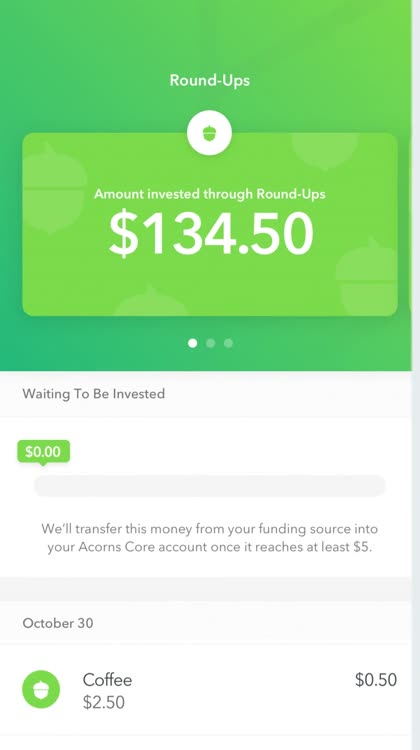

Let our automation purchase shares for you. The algorithm will never sell unless you tell it to. Enjoy tax-smart selling when you do.

Fractional shares let you invest as little as one dollar for more power and flexibility. If you choose to transfer your account to another broker-dealer, only the full shares are guaranteed to transfer. Fractional shares may need to be liquidated and transferred as cash.

One-click rebalancing makes sure your investments match your goals.

INVEST - CRYPTO

M1 offers investing in cryptocurrencies, including BTC and ETH. You can make Crypto part of your long-term investing strategy, invest automatically in custom pies, commission-free.^

SPEND

Earn and reinvest cash back as you like with the Owner’s Rewards Card. You can automatically reinvest your rewards money to build wealth—even as you spend it.

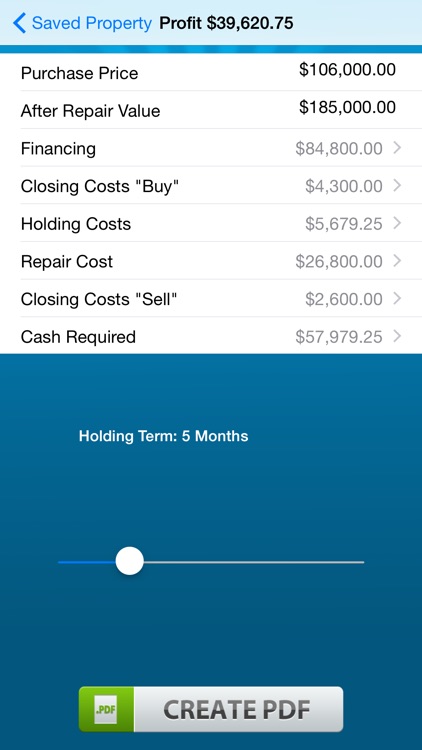

BORROW - MARGIN

Margin lets you tap into the power of your portfolio through a line of credit set against your investment account. Qualified brokerage accounts with over $2,000 invested get built-in access to margin.

Leverage up to 50% of your portfolio at a rate of 7.25%. Tap into your funds in minutes for liquidity without selling off your securities.

No paperwork. Pay back on your schedule—there’s no minimum or maximum repayment period.

BORROW - PERSONAL LOANS

Borrow $2,500–$50,000 over 2-7 years for almost anything.

No prepayment penalties, origination fees, or late fees.

APRs can vary between 7.99% - 21.75% APR. Rates are not guaranteed and are subject to change. Not all applicants qualify for the lowest available rate.

Example: A borrower receives a loan of $15,000, for a term of 36 months, with an APR of 11.17%. In this example, the borrower will make 36 monthly payments of $429.31 for a total of $17,723.16 ($2,723.16 interest). APR is calculated based on 3-year rates offered in Jan 2024.

PLAN FOR RETIREMENT

Open a Traditional, SEP, or Roth IRA or rollover a 401(k).

Automate and think about maxing out your retirement contributions with recurring deposits and auto-invest functions.

ACCOUNT PROTECTION

M1 Finance LLC, Member of SIPC. Securities in your M1 investment accounts protected up to $500,000. For details, see www.sipc.org.

Additional DISCLOSURES

See disclosures in the final screenshot above or visit https://m1.com/legal/disclosures

M1 refers to M1 Holdings Inc., and its affiliates. M1 Holdings is a technology company offering a range of financial products and services through its wholly-owned, separate but affiliated operating subsidiaries, M1 Finance LLC and M1 Spend LLC.

Must be 18+ and US resident to open an account.

Brokerage products and services are not FDIC insured, not bank guaranteed, and may lose value. M1 Finance LLC, Member FINRA / SIPC.

All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

© Copyright 2024 M1 Holdings Inc.

App distributed by: M1 Finance LLC; 200 N LaSalle St., Ste. 800; Chicago, IL 60601; United States