Through Faircent Double, you can invest in loans directly given out to India’s creditworthy individuals and small businesses, and earn stable and high returns, just like you would in a bank

Faircent Double

What is it about?

Through Faircent Double, you can invest in loans directly given out to India’s creditworthy individuals and small businesses, and earn stable and high returns, just like you would in a bank. Unleash the true earning potential of your investments with P2P Lending.

App Screenshots

App Store Description

Through Faircent Double, you can invest in loans directly given out to India’s creditworthy individuals and small businesses, and earn stable and high returns, just like you would in a bank. Unleash the true earning potential of your investments with P2P Lending.

Earn up to 12% pa* with Faircent Double

DOWNLOAD THE APP TO GET STARTED NOW!

WHY GET STARTED WITH P2P LENDING ON THE FAIRCENT DOUBLE APP?

- Multiple plans to suit your investment needs

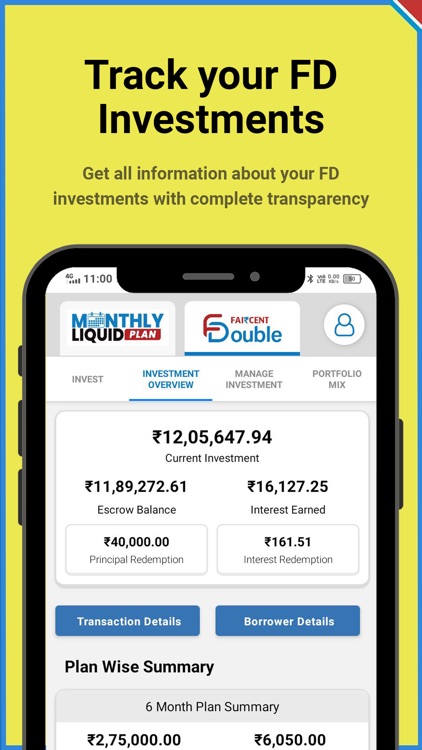

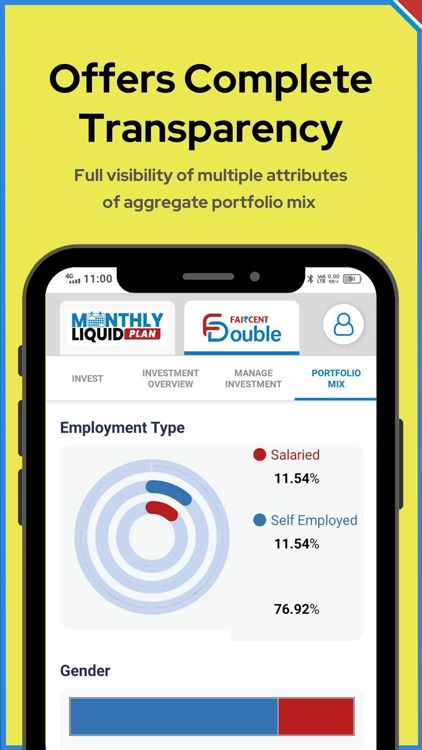

- High returns with complete transparency

- AI & Analytics driven unique diversification algorithms

- Seamless liquidation of returns

- Continuous analytics-based loan portfolio monitoring and optimization

- Aggregate portfolio mix reports covering: Age, Gender. Product Mix, Collection Performance, Credit History, Education, Employment Type of Borrowers

- No processing fee. Performance linked portfolio management fee

- Low correlation with the stock market and higher returns than other debt options

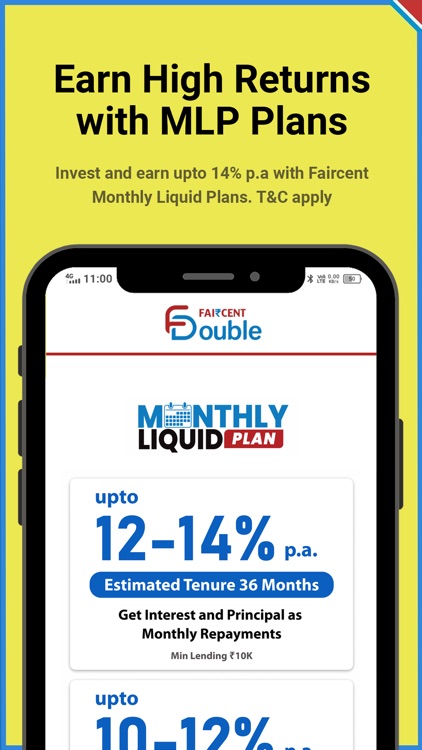

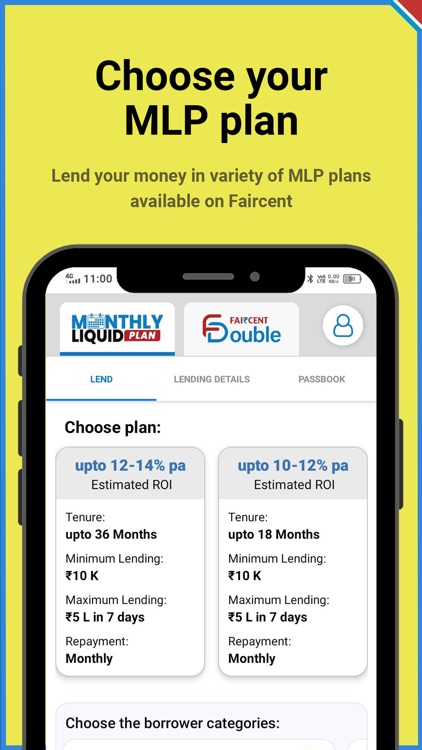

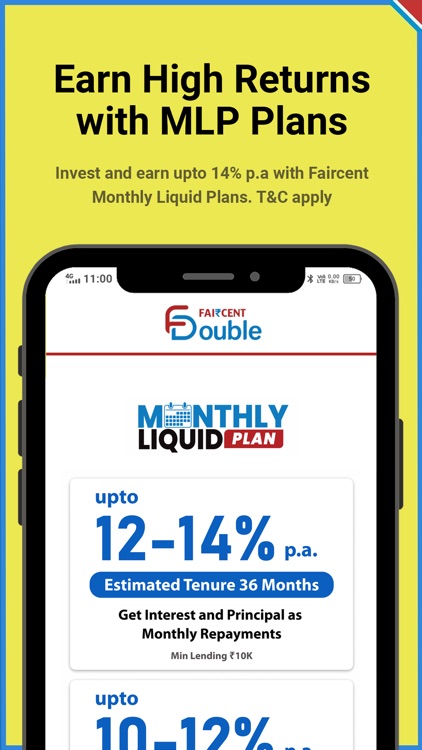

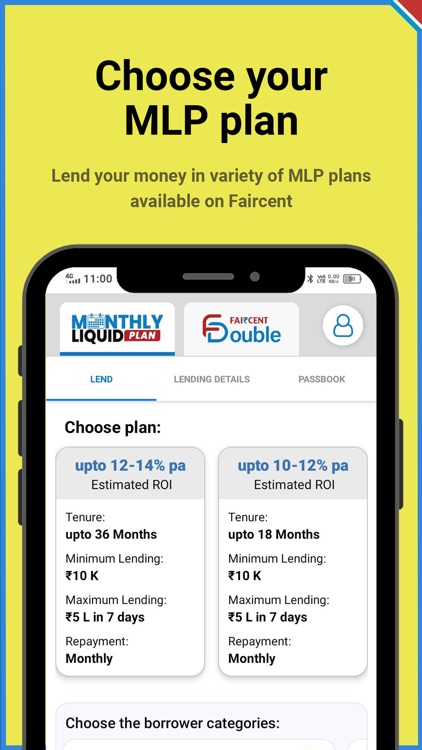

CHOICE OF PLANS FAIRCENT DOUBLE OFFERS TO P2P LENDERS

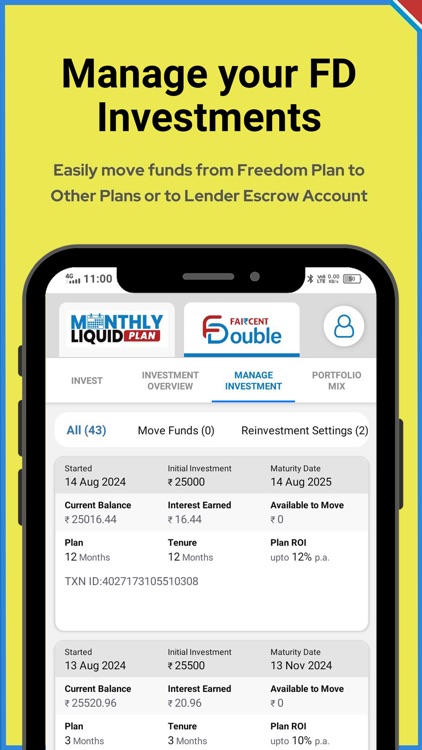

You can choose from a range of plans that suit your every need.

- Fixed Term Plans with multiple term options.

- Monthly Income Plan as a source of secondary, passive income.

- Or, invest in the Freedom Plan and withdraw funds whenever you want post 24 hours.

Download the app now to know more about the latest interest rates offered, minimum investments needed, and other details for each of these plans.

HOW FAIRCENT DOUBLE OFFERS CONSISTENT AND STABLE RETURNS UP TO 12% P.A.?

- Various lenders, just like you, invest money in a plan of their choice. The money is pooled in a single corpus

- Loans are disbursed to borrowers only with a healthy credit score (rates from 10% p.a. to 36% p.a.)

- Data science and algorithms automate portfolio management and optimize returns

- Loans are collected back using analytics-based methods, backed by a strong recovery process

- The loan repayments are pooled, and you are paid back up to 12% p.a., based on your chosen plan.

- Our fees are performance-linked, payable only when you have earned the returns as per your investment plan

- Your money can be reinvested to enable it to generate compounded returns.

HOW TO GET STARTED WITH P2P LENDING ON THE FAIRCENT DOUBLE APP?

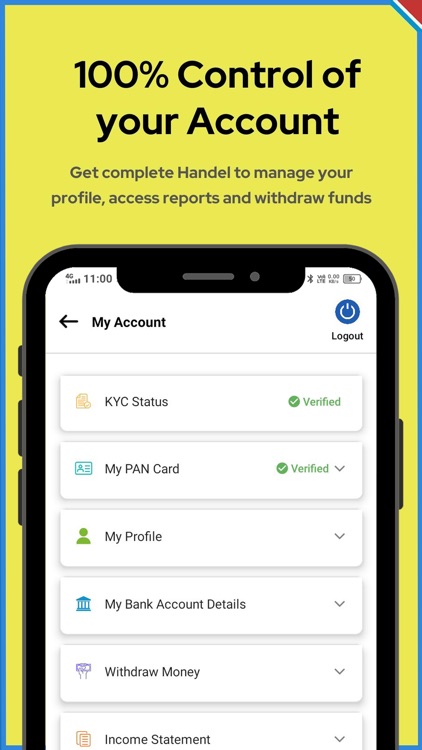

- Download the Faircent Double App

- Complete your registration

- Choose a suitable Faircent Double Plan to Invest in

- Add money from your bank account

- Start generating high returns

- Monitor your investments and reinvest to compound your returns

Brought to you by FAI₹CENT - India’s leading Peer to Peer Lending ((P2P Lending) platform and first NBFC-P2P to receive a Certificate of Registration (CoR) from the RBI. Fairassets Technologies India Pvt Ltd (Faircent.in) has an NBFC-P2P Certificate of Registration with the number N-14.03417 provided by the Reserve Bank of India.

* Terms of use @ https://www.faircent.in/terms-conditions

Please read the terms of use thoroughly before investing.

* Privacy policy @ https://www.faircent.in/privacy-policy.

* Support

double@faircent.in for queries related to Faircent Double

support@faircent.in for other queries.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.