About LenDenClub

LenDenClub - P2P Lending

What is it about?

About LenDenClub

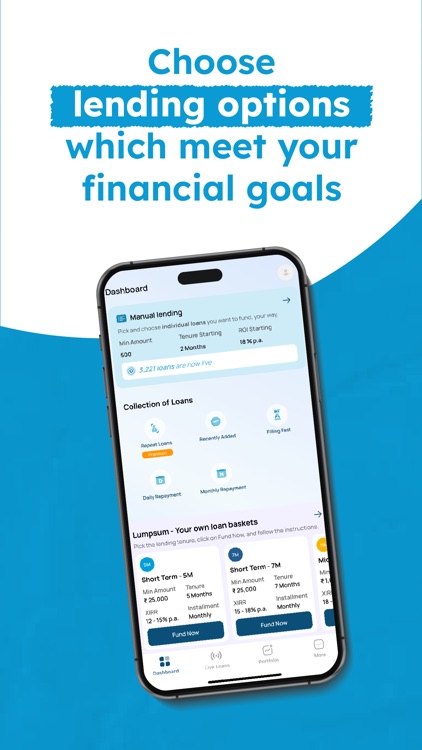

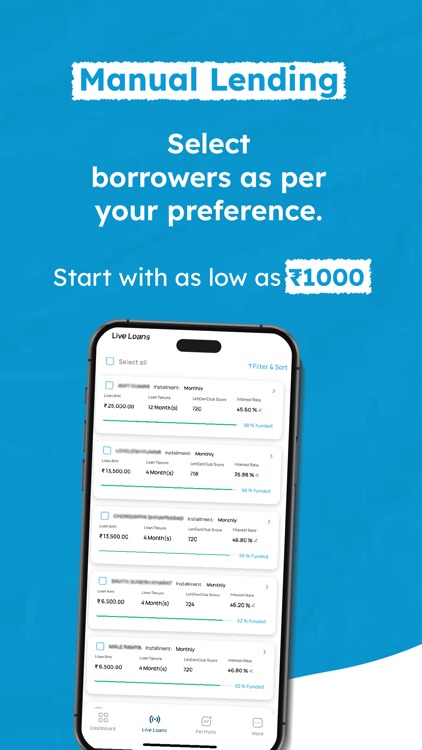

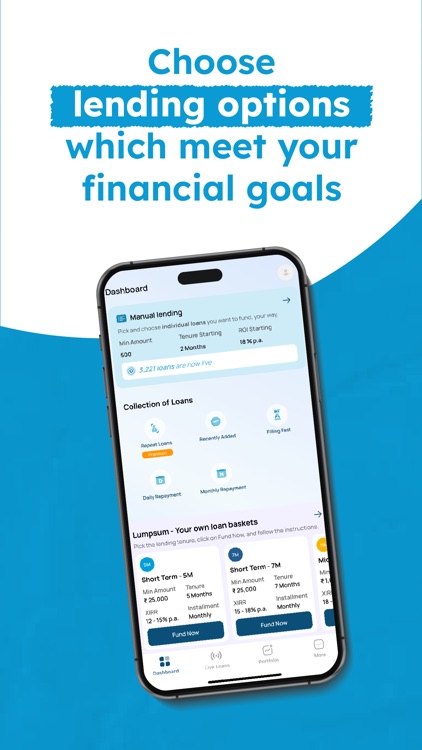

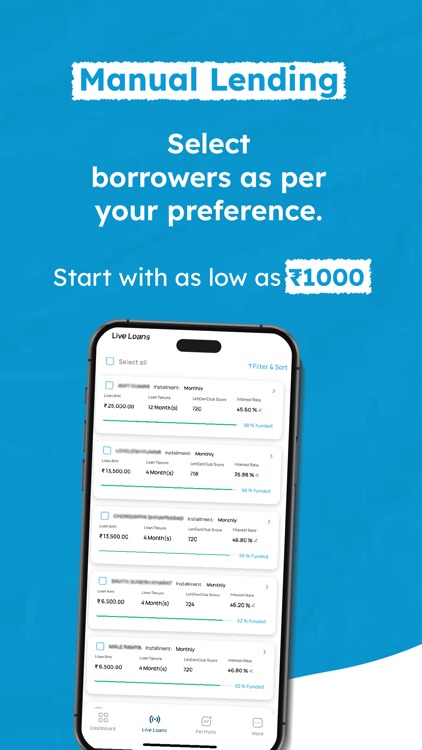

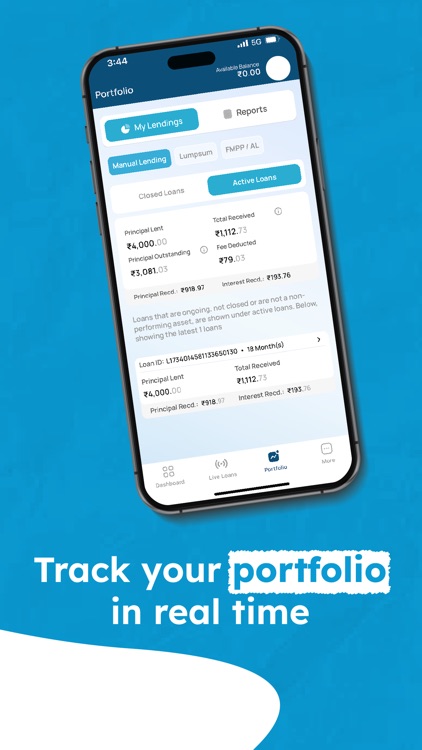

App Screenshots

App Store Description

About LenDenClub

Hardik ne choose kiya LenDenClub, aap kab karoge?

Invest like Hardik with India’s largest Peer-to-Peer (P2P) Lending platform. LenDenClub, owned by Innofin Solutions Pvt. Ltd. is an RBI-registered P2P-NBFC successfully operating a safe and trusted financial platform since 2015. FMPP investors have earned up to 12% p.a. since its launch.

Why LenDenClub?

* Low minimum investment amount of INR 10,000

* Trusted by 20 Lakh+ investors

* INR 11,000 Cr Investments on the platform since inception

* RBI-registered NBFC-P2P

* Secure Funds Handling through ICICI Trusteeship Services

FMPP performance (Annualized Returns) in Q3-FY23

Max: 12.91%

Average: 11.95%

Min: 11.01%

How does FMPP work?

FMPP invests your money via proprietary AI algorithms into creditworthy borrowers seeking loans. All borrowers on the LenDenClub platform undergo rigorous KYC and credit assessment checks on more than 600 parameters. Also their robust repayment mechanism is supported by a dedicated collections team.

Credit risk is further mitigated by AI-powered hyper diversification of invested amounts (as low as ₹1). These factors combined together sets it apart from the other investment options.

Key features of FMPP

* Start investment with as low as INR 10,000

* Zero account opening fee

* No withdrawal charges

* Industry-best referral plans (Passive income)

* 100% digital account opening process

* Secure handling of funds via ICICI Trusteeship Services

* Maximum investment amount INR 50,00,000

Documents Required:

- PAN Card

- Aadhaar Card

- Photo

Eligibility Criteria:

One should be an adult Indian citizen with a valid KYC and Indian bank account to become an investor on the platform.

An adult NRI with NRO account and Indian PAN is eligible too.

For any queries, kindly contact us at invest@lendenclub.com

Security & Protection of Privacy

LenDenClub app follows global standards of high-level data encryption/decryption protocols to protect user data.

*Risk Disclaimer: P2P investment is subject to risks. And investment decisions taken by a lender on the basis of this information are at the discretion of the lender, and LenDenClub does not guarantee that the loan amount will be recovered from the borrower.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.