Central / State Goods and Services Tax (GST) of India

GST Act Rules Practice India

What is it about?

Central / State Goods and Services Tax (GST) of India

App Store Description

Central / State Goods and Services Tax (GST) of India

Goods and Services Tax of India commonly known as GST is a major tax reform applicable all over India replacing major tax laws relating to manufacturing (Excise Duty), Sales Taxes (CST and VAT) and Service Tax. The coverage and tax base widened keeping in view centralized taxation system and globalization of Indian businesses.

This app provides information on Goods and Services Tax GST, SGST, CGST, IGST, GST Applicability, GST Section Wise Details, GST Rules, GST Forms, GST Faqs, GST practice and GST Consultants list.

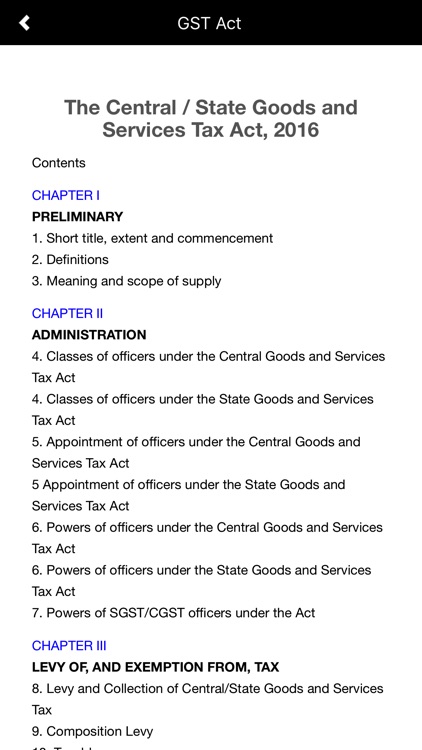

The GST Act divided into chapters and schedules which are provided inside the app.

GST Rules and Forms as Follows:

• Return Rules

• Return Formats

• Refund Rules

• Refund Formats

• Registration Rules

• Registration formats

• Payment Rules

• Payment formats

• Invoice Rules

• Invoice formats

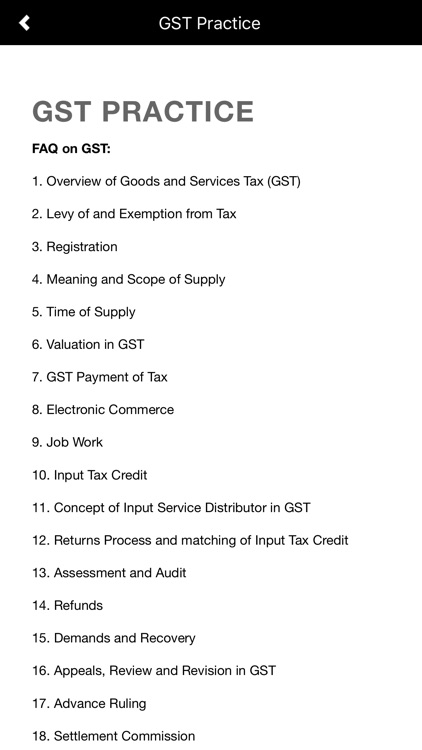

This app also includes GST practice to cover practical aspects of GST including FAQs and other formalities of GST law in India. A section provided for GST consultants to enlist themselves inside the app.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.