InstaFunds helps you to become more financially organized and disciplined, while also increasing your financial literacy

InstaFunds - Checkbook (Finances, Spending, Accounts + Pic Option)

What is it about?

InstaFunds helps you to become more financially organized and disciplined, while also increasing your financial literacy. Our goal is to not only be a simple money tracking app, but a budgeting tool and educational tool.

App Screenshots

App Store Description

InstaFunds helps you to become more financially organized and disciplined, while also increasing your financial literacy. Our goal is to not only be a simple money tracking app, but a budgeting tool and educational tool.

InstaFunds Free is a simple way to keep track and organize your money. Use our app to keep track of all of your transactions and also to access the resources provided tol help you in making financial decisions.

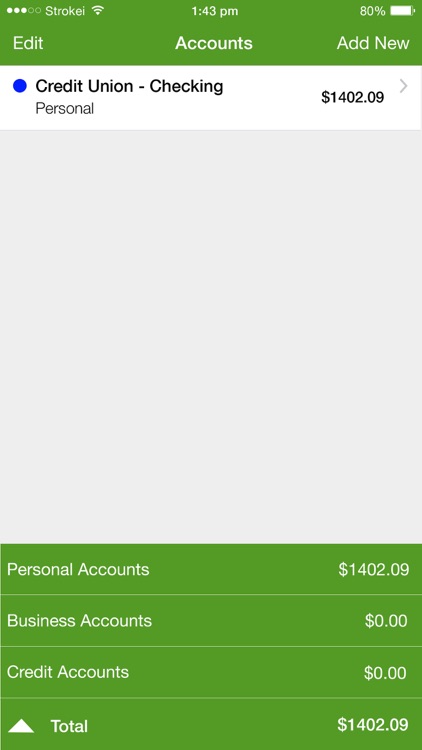

ACCOUNTS

The app allows you to manually enter past, present, and even future transactions. Use InstaFunds as your personal finance manager. The ability to add future transactions also means you are able to budget by knowing how much you should have in your account at the end of a certain time period based on the current and predicted future transactions that will come from an account.

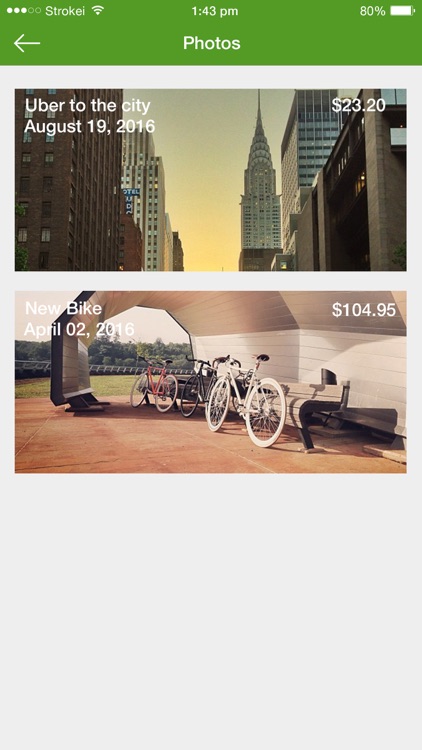

Use InstaFunds as your digital checkbook with the option of identifying what you purchased or used with each transaction (i.e. check, receipt, picture of the purchased item from the store) by taking a photo and attaching it to any transaction.

You can list your account as personal, business, or checking. You can also identify the type of account by labeling it as checking, savings, CDs, or numerous other options.

RESOURCES

Through InstaFunds, we will offer your numerous resources and opportunities to become more financially literate. Our resources include interviews, helpful articles, recommendations, and definitions and explanations about things you may see when trying to get a loan, credit card, or something similar. We want to make sure you are knowledgeable enough to make the right decision.

With a focus on the unbanked, underbanked, and under-resourced, we understand that many people are getting loans with extremely high interest rates, cashing their checks at the local store for a fee, and/or so deep in debt that they become hopeless. We use our resource section as a way of putting people on the right path to financial freedom.

OTHER FEATURES

- E-mail yourself personal transactions or export full accounts.

- Import data Now you have a record of your finances on your mobile device and on your computer.

- turn Reconcile on or off

- turn Security Code on or off. If your Security Code is on, you must enter a 4 digit code in order to access your accounts.

- Search feature to easily search through your transactions in all your accounts. Search by name, amount, or date.

- Order your transactions by Date, Clearance, or Amount

- Categorize your transactions. By visiting the 'Category' page, you will be able to see the amount and percentage of money you have spent in each category. (You are free to add any category that is not already part of the app by default)

- Print off transactions. This includes printing off the picture that has been taken/assigned to each transaction.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.