Money Reel Online Instant Personal Loan App, Insurance & Credit Card Online

MoneyReel

What is it about?

Money Reel Online Instant Personal Loan App, Insurance & Credit Card Online

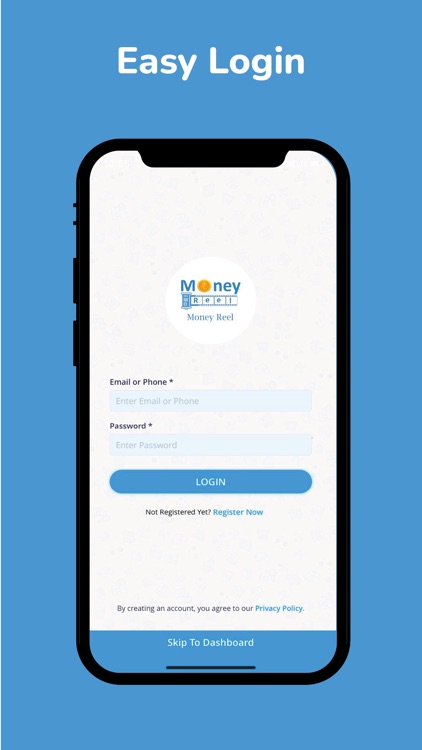

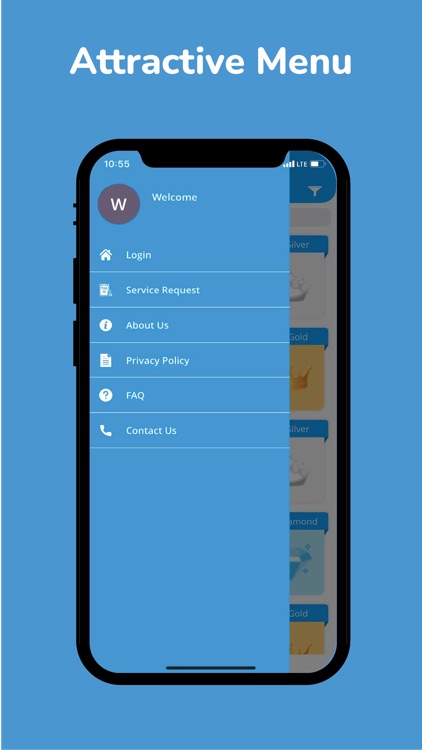

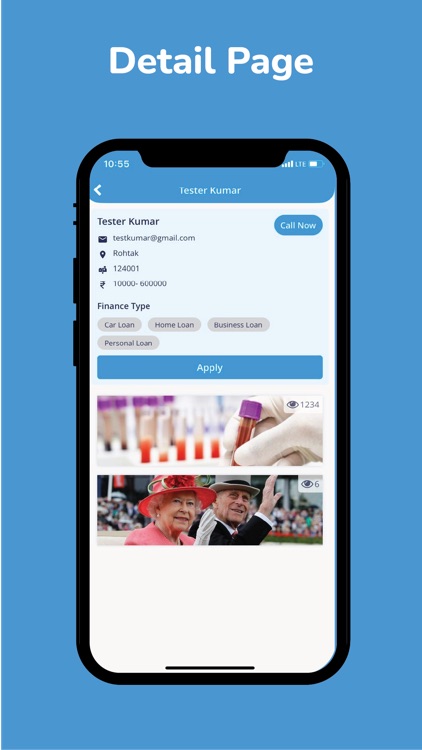

App Screenshots

App Store Description

Money Reel Online Instant Personal Loan App, Insurance & Credit Card Online

We at CTOF Money Solutions Private Limited Provide one of the fast loan in India, and help you take benefit of our loan service in a faster manner.

Money Reel[brand name of CTOF Money Solutions Private Limited] is a Personal Loan Platfrom. We are constantly optimizing and improving our functions to provide users with better performance, faster and more reliable loan services. Money Reel focus on peronal lending. Money Reel has the advantages of high quota. as your credit score grows, the sanctioned loan amount increases for every loan.

Money Reel amount starting from ₹ 2000 to ₹ 200000 and Loan period for 3 month to 48 month and our loan interest rate Starts From 0.5% to 1% per month and transaction fee is zero and no processing fees are applicable.

Money Reel meet users financial needs with 24x7 online availability for loan services.

Money Reel is an instant personal loan application & credit platform for across nation, where one can apply for personal loan online & avail up to ₹2,00,000 lakh.

Money Reel characteristics:

- Loan amount from ₹,1000 to ₹2,00,000

- Repayment periods from 3 Month to 24 Month

- APR from 3.5% to 12% per annum

- Processing fees [whenever will be applicable]range from 2.5% to 5% (GST 18% applies)

- You may be charged up to 0.1 % daily late fees for late payments ( capped to 18% of principal amount overdue ).

- No other hidden fees applicable to your loans!

Examples on How its works

- Credit ₹5,000 at an APR of 12% (per annum) with a tenure of 61 days

- Interest of loan = ₹5,000 x 12 %/ 365 x 60 = ₹100

- Processing fee of loan = ₹5,000 x 3% = ₹125 (Also on which GST apply of ₹27). Free for now.

- Total loan amount to repay will be ₹5,100 (₹5,000 + ₹100)

- Monthly repayments of ₹2,550

What Money Reel can provide?

- Instant personal loan : Get personal loan online with amounts up to Rs. 2,00,000 to both salaried and self-employed person.

- Anytime and anywhere loans : provide instant personal loan apps in india 7/24 and cover the your costs with our instant loans only in india.

- Loan Anytime: Only one time approvals.

Loan requirements :

- Indian Resident.

- Have a bank account.

- Above 18 years old.

- Valid Document

- Should have monthly source of income

- Should have proper identity and address proofs.

Personal Loans

With Money Reel App, Our personal loans are starting from minimum ₹ 10,000 to maximum ₹2,00,000 with tenure from minimum 3 Months to 48 Months with APR minimum 3.5% to maximum 12% depending upon the personal loan amount.

Why Money Reel ?

- Simple to use

- No bank credit card required.

- Get 7*24 access anytime and anywhere.

- High loan approval rate.

- Quick personal loan Approvals.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.