Discounted cash flow (DCF) valuation considers the intrinsic value of a stock as the present value of its expected future cash flows

DCF Valuation

What is it about?

Discounted cash flow (DCF) valuation considers the intrinsic value of a stock as the present value of its expected future cash flows.

App Screenshots

App Store Description

Discounted cash flow (DCF) valuation considers the intrinsic value of a stock as the present value of its expected future cash flows.

We use DCF analysis to value a company and its equity shares by valuing free cash flow to the company (FCFF) and free cash flow to equity (FCFE).

Analysts often use more than one method to value a stock and it is clear that free cash flow analysis is almost universally used.

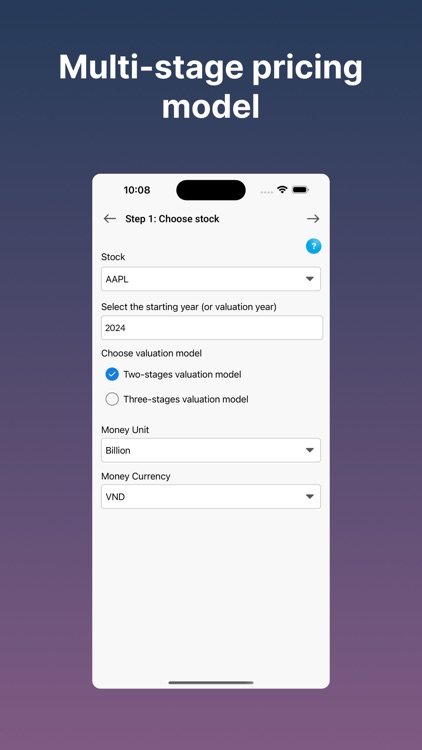

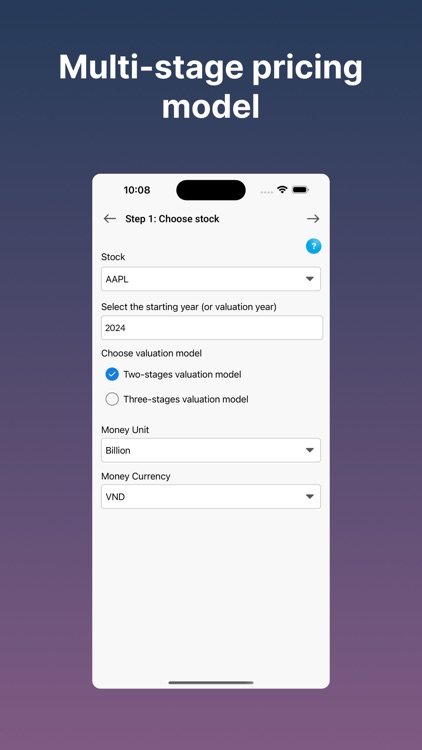

Throughout the steps, the application will help you enter the necessary data, you can change the parameters as you like (appropriately) to finally value a stock at a reasonable value, and use it in your investment process.

There are many ways to calculate FCFF, FCFE values, but in this application we use the popular formula with the input of cash flow from business operations (CFO), capital expenditure (Capex), interest expense (IE) and net debt.

Main functions:

- Valuation of stocks using DCF model with 2 methods FCFF and FCFE

- Select 2-stage valuation model or 3-stage model

- Save analysis history for comparison and evaluation

- Customize parameters such as interest rate, risk-free rate of return, tax rate... for in-depth valuation analysis

- Share valuation results

Terms of Service:

https://fuptrend.wordpress.com/term-of-service/

Privacy Policy:

https://fuptrend.wordpress.com/privacy-policy/

Contact: stockinvestapp@gmail.com

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.