The Debt 2 Wealth Mobile APP is designed for agent that specialize in financial analysis for their clients

Debt2Wealth Calculator

What is it about?

The Debt 2 Wealth Mobile APP is designed for agent that specialize in financial analysis for their clients. Most of them are currently insurance agents, debt management, or financial advisors.

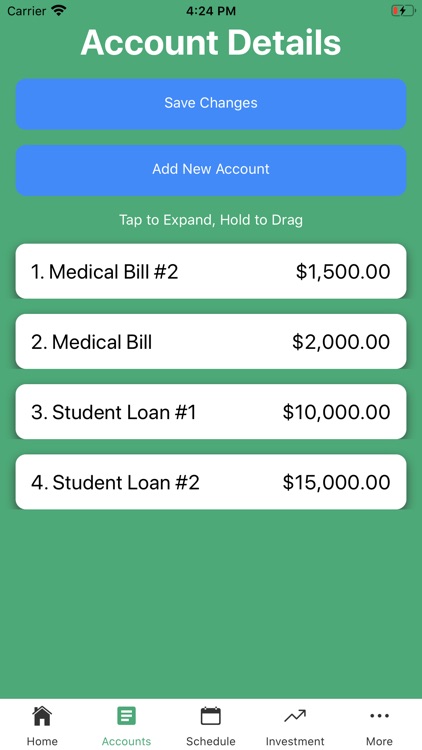

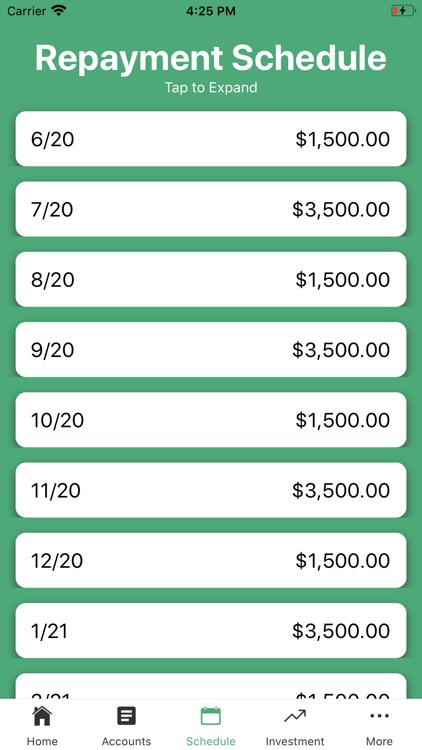

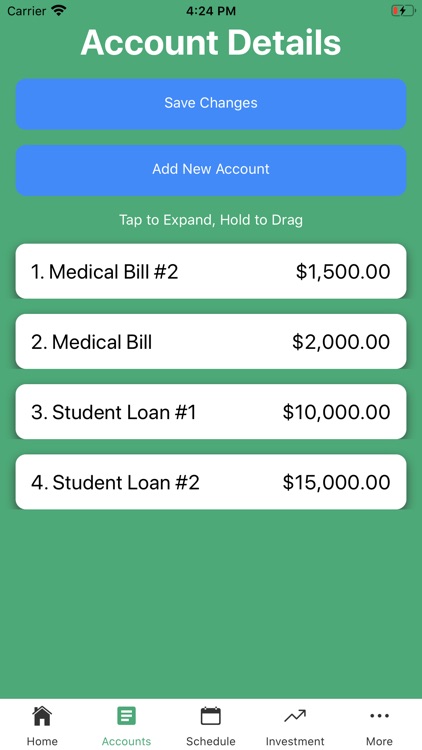

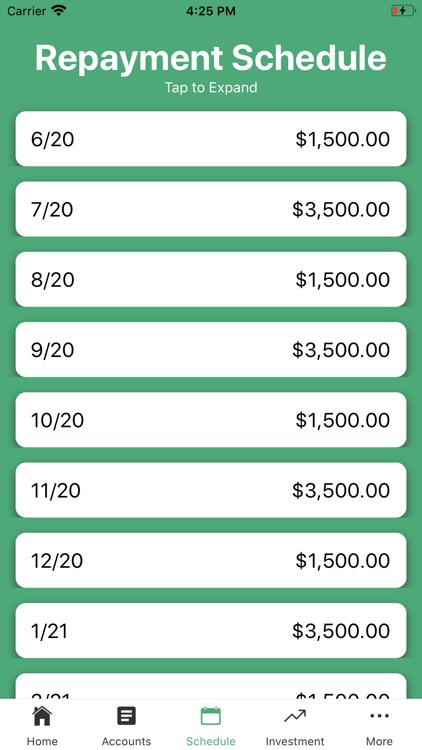

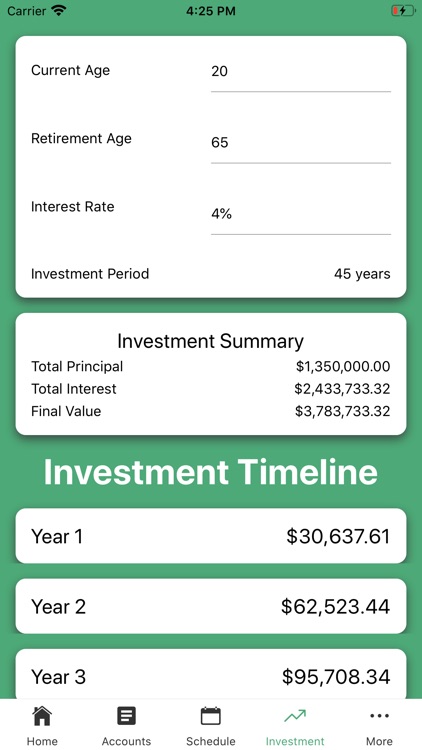

App Screenshots

App Store Description

The Debt 2 Wealth Mobile APP is designed for agent that specialize in financial analysis for their clients. Most of them are currently insurance agents, debt management, or financial advisors.

It can be used in the home or as a virtual consultation with their client to show them how to pay down their debt in 2-4 years, not including their mortgage. If you include the mortgage, they will pay off all their debt in 1/3 to 1/2 off the traditional time. When you pay a mortgage using the regular amortization you will pay for the home 2 ½ times the purchase price. (Secret the banks do not want you to know).

It compares and runs to different approaches to paying off the debt. The app will so the date the debts will be paid off. We have another system that will accelerate your debt payoff that you will see when you use the APP

We also show you how to turn that debt into wealth using our system.

Snowball – This method of repaying multiple debts by paying off the debt in the lowest amounts to highest in that order. You see fast results and it is easier to get more excited while watching it. When you pay off the first debt you will then roll that payment on top of the next debt payment paying down the principle fast. So hence the name Snowball. You will pay more interest but often pay your debt off fast with this method.

Avalanche - This method of repaying multiple debts results in the lowest total interest cost by prioritizing the repayment of debts with the highest interest rates, while paying the minimum amounts for each other debt. This continues like an avalanche, where the highest interest rate debt tumbles down to the next highest interest rate debt, until every debt is finally paid off and the avalanche is over.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.