Create and control your own bespoke portfolio

iProtect lite

What is it about?

Create and control your own bespoke portfolio

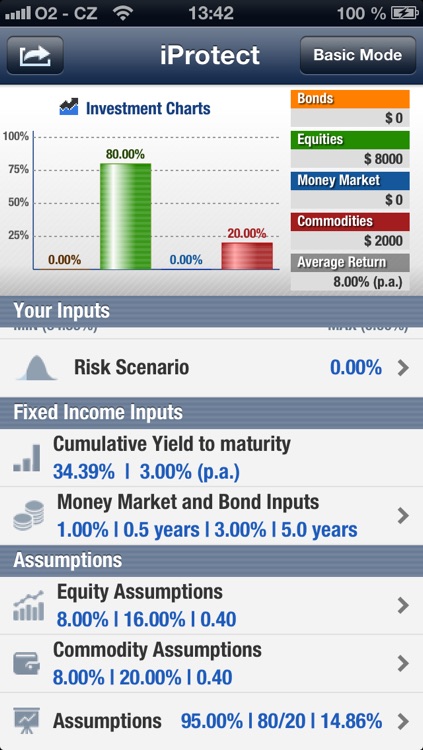

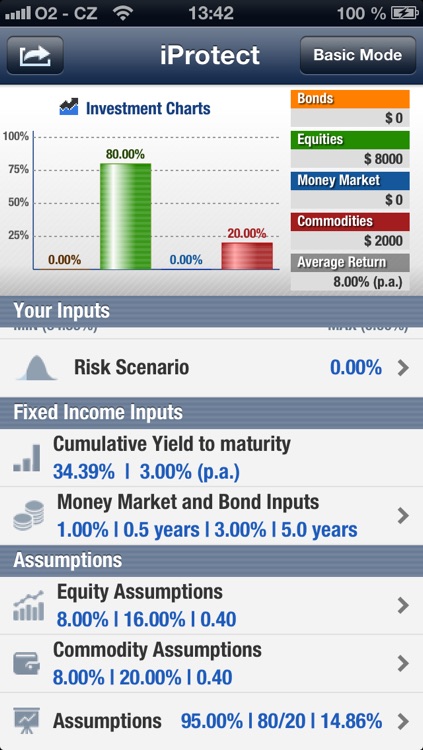

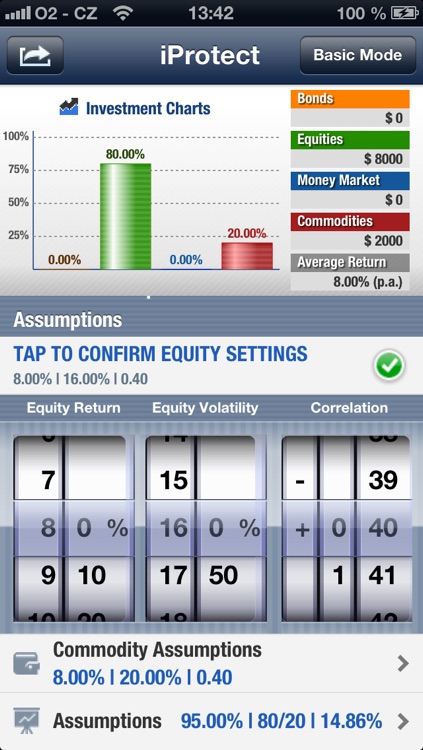

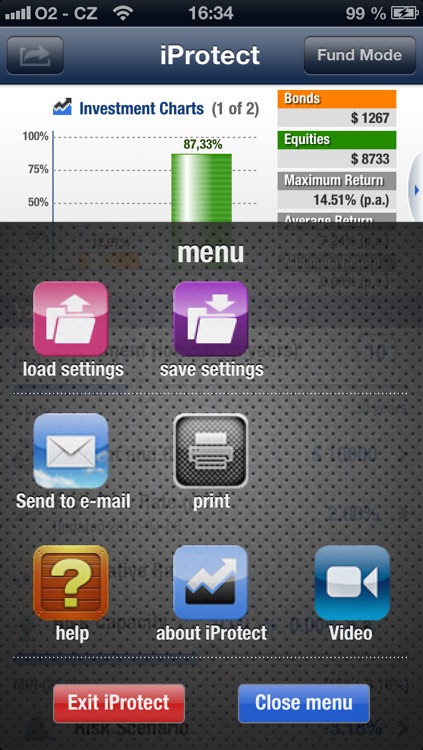

App Screenshots

App Store Description

Create and control your own bespoke portfolio

The Investment Horizon is locked to 3-9 years in FREE version.

BEGINNERS USE BASIC MODE. ADVANCED INVESTORS/ADVISORS USE FUND MODE.

iProtect is a new tool with which you can create your own tailor-made, capital-protected portfolio.

There is a mistaken belief among many, that investors should, by default, be classified according to stereotypical “risk groupings” which are, at best, crude and, at worst, completely misleading.

This belief should be replaced by one for which the guiding principle is that the investor is in control of the asset allocation decision.

iProtect changes the common approach towards clients from one which compromises their needs by using existing pre-prepared models to one in which investors can get their asset allocation tailored to their individual needs.

With iProtect the individual has more control over his or her investments. The portfolio is intelligent, transparent and principal protected and not complicated or unnecessarily complex.

The iProtect application gives the investor the power to:

◦create a portfolio consisting of bonds and equities tailor-made to the individual

◦avoid unwanted speculation

◦identify which assumptions about future market development are built into the allocation

◦check the usefulness of the suggestions that have been given by advisors

◦calculate the average, minimum and maximum return of the portfolio at any time

◦experiment with different scenarios to find the best solution

◦save on commission and advisory fees

◦be educated in risk/return trade-off more easily than ever before

Armed with the asset allocation from iProtect, the investor can then buy inexpensive, diversified and transparent index funds without paying high fees. Investor can use an actively managed fund with proven long track record as well.

The Author is a CFA charterholder.

See 5-minute video via Support URL

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.