QIDTM designed to assist investors in systematically building and safeguarding their retirement corpus by integrating six pivotal elements essential for long-term investing

QID

What is it about?

QIDTM designed to assist investors in systematically building and safeguarding their retirement corpus by integrating six pivotal elements essential for long-term investing. This comprehensive strategy aims to provide a holistic framework for individuals to secure a financially stable and fulfilling retirement.

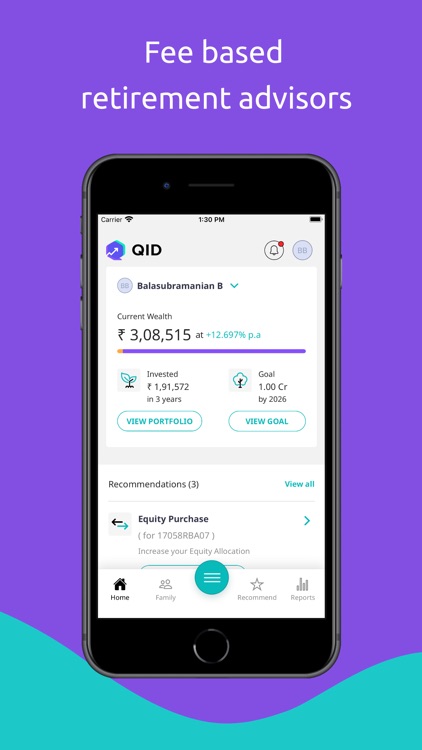

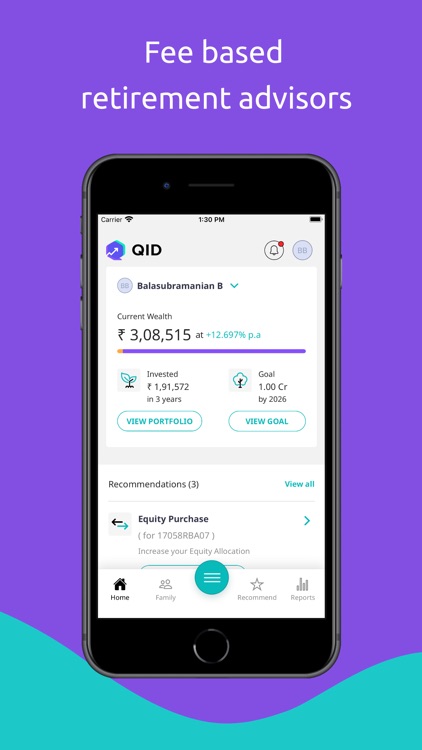

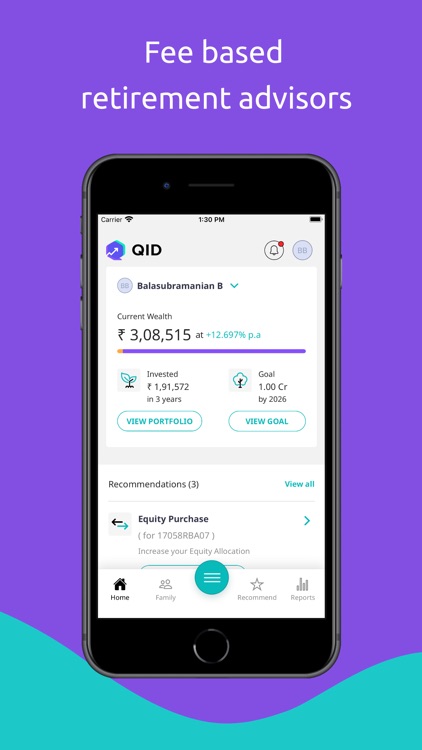

App Screenshots

App Store Description

QIDTM designed to assist investors in systematically building and safeguarding their retirement corpus by integrating six pivotal elements essential for long-term investing. This comprehensive strategy aims to provide a holistic framework for individuals to secure a financially stable and fulfilling retirement.

1. Setting Precise Retirement Goals: The first fundamental element of QIDTM revolves around defining precise retirement goals. These objectives are carefully crafted, taking into account various critical factors such as an individual's desired lifestyle post-retirement, their family background, current income status, and other pertinent parameters. By meticulously analyzing these aspects, investors can create a realistic and tailored plan to achieve their retirement aspirations.

2. Periodic Rebalancing of Portfolio: To ensure optimal performance, QIDTM advocates for periodic rebalancing of an investor's portfolio. Recognizing that market fluctuations are an inherent part of medium to long-term investments, the strategy emphasizes the importance of maintaining the desired asset allocation. Through periodic adjustments, the portfolio can effectively minimize volatility while capitalizing on market opportunities presented during corrections.

3. Minimizing Fund Management Costs: QIDTM approach acknowledges the impact of fund management costs on investment returns. Many investment options currently levy an average annual fund management cost of around 2%, which can significantly erode long-term gains. To address this concern, the approach recommends opting for Direct Plan Index Equity Funds. By investing in such funds, the fund management costs can be substantially reduced to below 0.5%, leading to enhanced returns for investors.

4. Personalized Portfolio Allocation: Recognizing that each investor's financial circumstances and risk tolerance vary, QIDTM emphasizes the importance of creating a personalized portfolio. The allocation of assets is tailored based on factors such as an individual's income, age, prevailing market conditions, and other relevant considerations. This individualized approach seeks to optimize the portfolio's performance and align it with the investor's unique financial goals.

5. Ability to Meet Emergency Situations: QIDTM acknowledges the possibility of unexpected emergencies arising during the long-term investment journey. To address this concern, the strategy incorporates measures to ensure the portfolio's ability to handle such unforeseen circumstances. By factoring in contingency plans, investors can feel more secure about their financial well-being and the capacity to address unforeseen financial challenges.

6. Reducing Tax Liabilities: Tax efficiency is a critical aspect of long-term investments, and QIDTM places significant emphasis on minimizing tax liabilities. Frequent switching of equity schemes can lead to higher taxation on investments. As a solution, the strategy suggests investing in Index Funds, which enable investors to hold their investments indefinitely, thereby reducing tax implications. Additionally, the approach encourages redemptions, if any, from family members in lower tax brackets to further optimize tax efficiency.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.