Lenditt- Instant Personal Loan App for Salaried & Self-Employed Individuals

Lenditt: Personal Loan App

What is it about?

Lenditt- Instant Personal Loan App for Salaried & Self-Employed Individuals

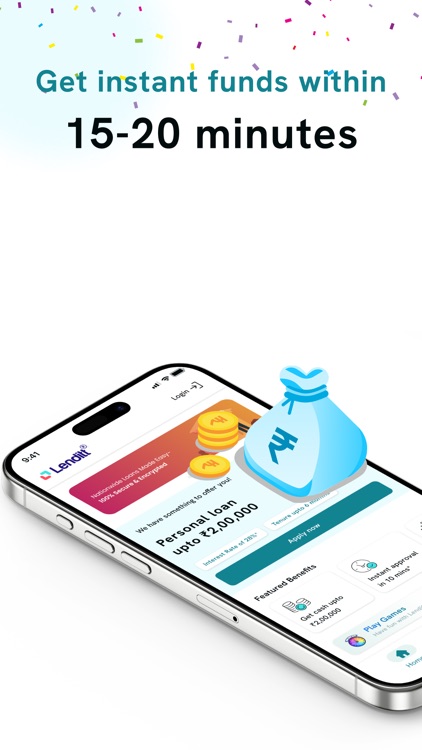

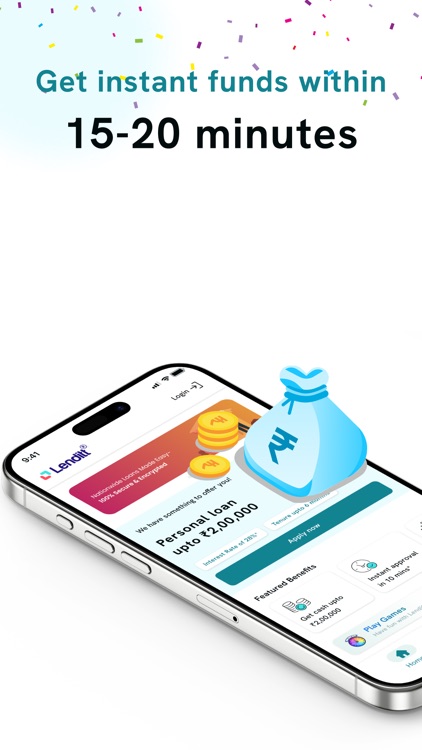

App Screenshots

App Store Description

Lenditt- Instant Personal Loan App for Salaried & Self-Employed Individuals

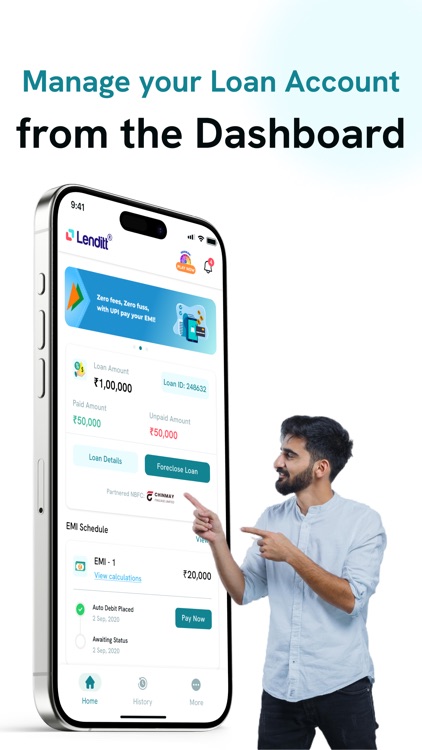

Lenditt is India’s trusted fintech company, offering instant Personal Loans from ₹10,000 to ₹3,00,000, with a repayment tenure upto 365 days (12 months) and an interest rate starting from as low as 28% p.a. With Over 2 million professionals have chosen Lenditt for fast, secure, and 100% paperless loans.

Loan Terms & Conditions

Loan Amount Range: ₹10,000 to ₹3,00,000

Quick Turnaround time: within 15 minutes

Repayment Tenure: upto 365 days (12 months)

Bounce Charges: ₹500

Interest rate starts from 28% p.a.

Annual Percentage Rate (APR) Range: 34% p.a.

Other Charges: Processing Fee (5%), Documentation Fee (1%), Online Convenience Fee (₹200) + GST as applicable

Example Annual Percentage Rate (APR) Calculation

Loan Amount: ₹30,000

Tenure: 180 days = 6 months = 0.5 years

Interest Rate: 28% p.a.

Total Interest = ₹4,104

Other Charges Calculation on Loan Amount: Processing Fee (5%) + Documentation Fee (1%) + Online Convenience Fee (₹200) = ₹2,000

GST on total Other Charges = ₹360

Total Deductions = Total Other Charges + GST

Net Amount Disbursed = Loan Amount - Total Deductions = ₹27,640

Total Repayable = ₹30,000 + ₹4104 = ₹34,104

Note:

PF, DC, and GST are deducted upfront at the time of loan disbursement.

This is an indicative calculation, interest and other charges vary based on your profile.

Eligibility Criteria

Age- 21 to 55 years

Indian Citizen with valid Aadhaar & PAN

Salaried professional with ₹20,000+ monthly income

Active bank account for salary deposits

Minimum credit score: 680+

Why Choose Lenditt?

• No collateral or guarantor required

• 100% paperless KYC process

• Flexible repayment options

• No upfront fees

• Lenditt only works with RBI-approved NBFCs

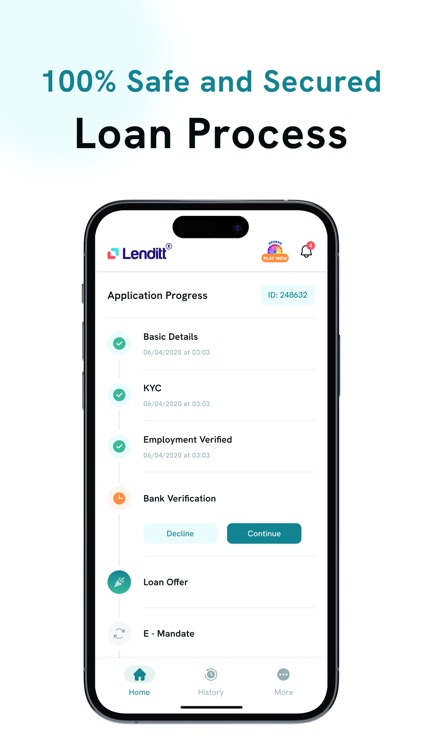

Steps to avail a Personal Loan from Lenditt

Download the Lenditt App

Sign up using your active mobile number

Check eligibility with PAN or Aadhaar Card

Upload KYC documents, including ID, address proof & PAN card

Provide your bank account details

Choose among the loan amounts proposed to you

Get money in your bank account

Our Lending Partners

Lenditt proudly collaborates with esteemed RBI-approved NBFCs.

Chinmay Finlease Limited- NBFC Registration Number- B.01.00558

Madhur Instalments Private Limited- NBFC Registration Number B-12.00396

Besides Instant Personal Loans, our additional-

Value-Added Services:

Digi Gold & Silver

Invest in 24K gold & silver, starting from just ₹1.

Home Loan

Your first Step Towards Homeownership!

Spend Analytics

Spend Analytics provides you with clear insights to manage your finances.

Health & Wellness Protection Plan

Affordable Health & Wellness Protection Plan starting from Rs 499.

Contact Us

Email: support@lenditt.com

Call: +91 7862839654

Address: Times Corporate Park, Thaltej, Ahmedabad- 380059

T&C Applied!

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.