Tax2290 eFile is an app to prepare and report Federal Vehicle Use Tax returns with the IRS

Tax2290 eFile

What is it about?

Tax2290 eFile is an app to prepare and report Federal Vehicle Use Tax returns with the IRS. Powered by TaxExcise and a product of ThinkTrade Inc.

App Screenshots

App Store Description

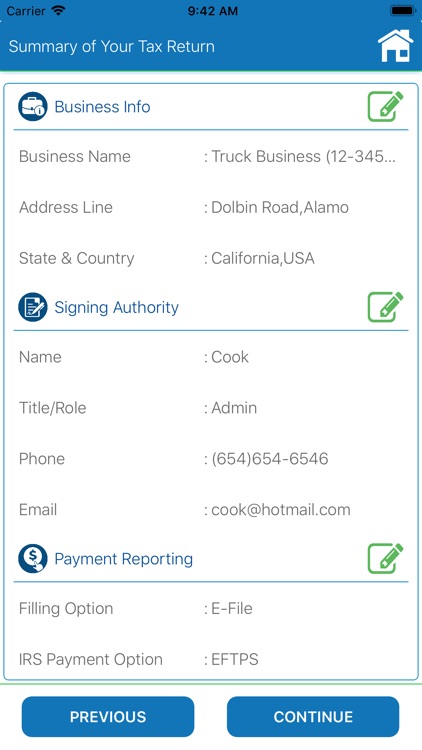

Tax2290 eFile is an app to prepare and report Federal Vehicle Use Tax returns with the IRS. Powered by TaxExcise and a product of ThinkTrade Inc.

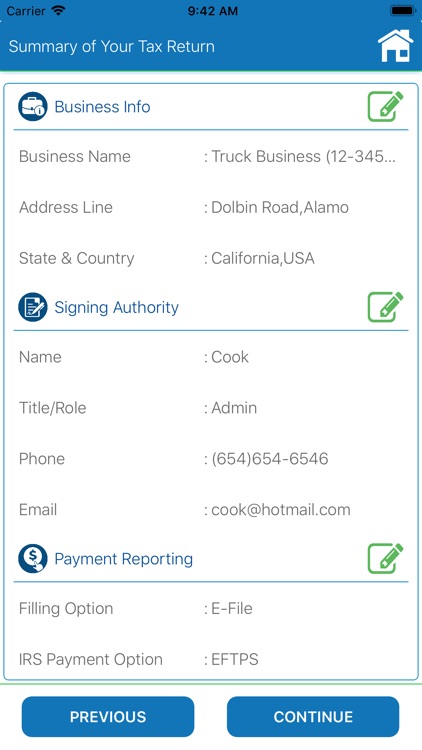

Tax2290 app supports truckers to prepare and report heavy vehicle use taxes electronically, receive back the IRS Stamped Schedule-1 “Proof for 2290 payment” acknowledgement immediately once IRS accepts your return – Guaranteed!

Tax2290 ease your 2290 tax preparations and reporting with accurate tax math, simple steps, secured and safe filing.

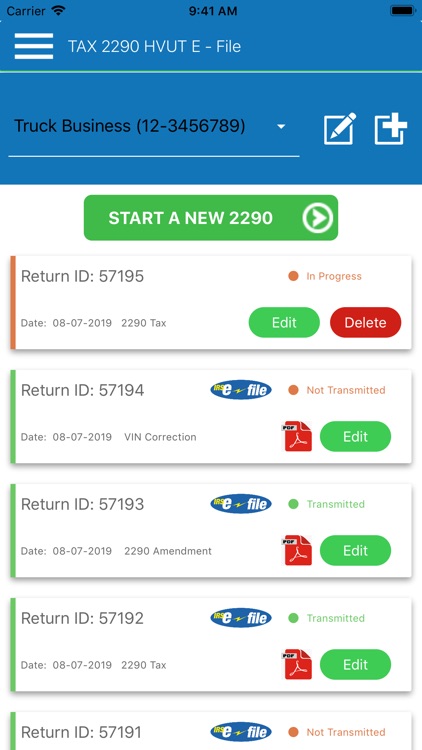

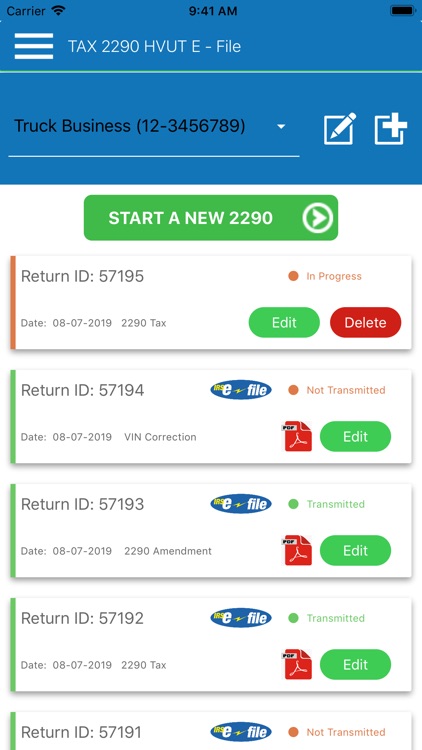

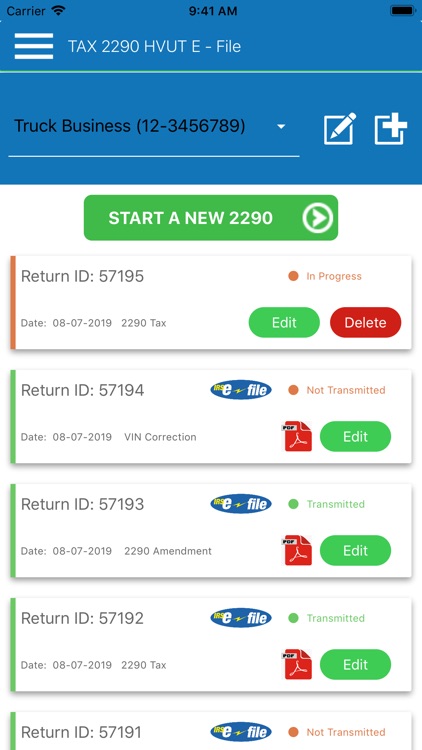

Use this Tax2290 eFile app you can report:

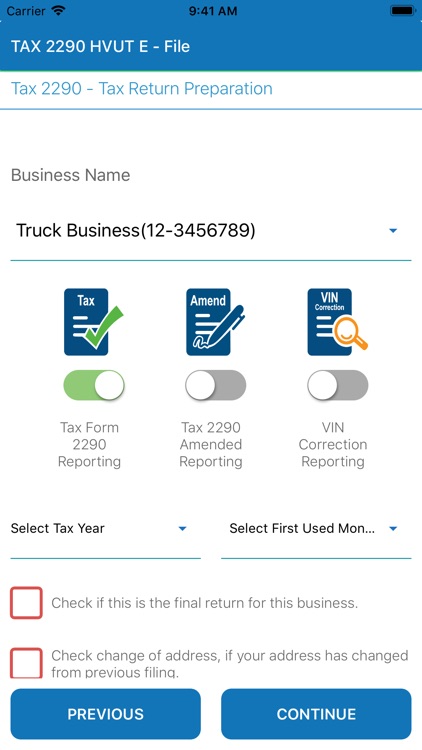

· Form 2290, Vehicle Use Tax Return

· Form 2290, VIN Correction E-file

· Form 2290, Tax Amendments

· Form 2290, Tax Refund Claims

One app to report all your 2290 needs!

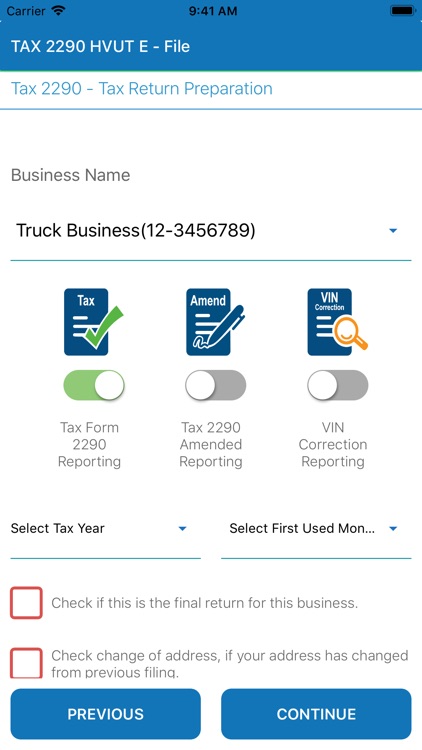

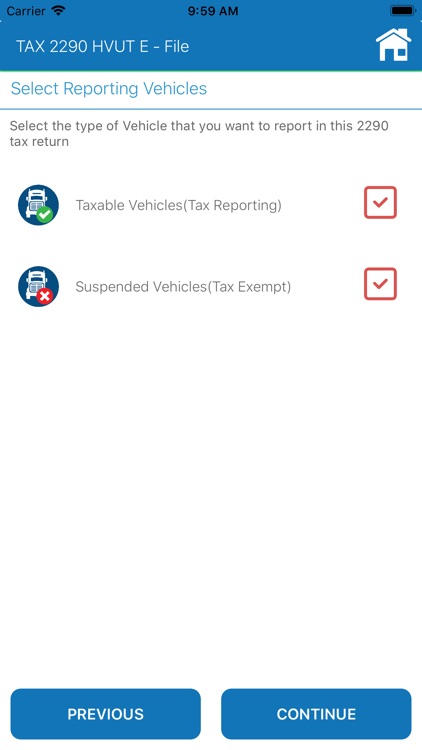

Tax Form 2290

The Federal Heavy Highway Vehicle Use Tax returns are reported and paid to the IRS using Form 2290. This is filed for a tax year starting from July 1 of current year through June 30 of the following year. Usually form 2290 is reported between July 1 to August 31 based on the first used month. The heavy vehicles with a taxable gross weight of 55,000 pounds or more qualify for 2290 taxes. Also when it is operated 5,000 miles (7,500 miles for Farming Vehicles) on a public highway 2290 taxes has to be reported and paid in full. This is an annual tax and paid in advance to the IRS. Form 2290 can be prepared and reported online using Tax2290 App.

Watermarked Schedule 1 Proof in Minutes.

When you efile 2290 federal vehicle use tax returns the IRS watermarked Schedule 1 proof of payment could be received in just minutes once IRS completes processing your return. This proof of payment can be used as a valid document to register your vehicles with the state authorities. Electronic filing is the fastest way to receive the Schedule 1 proof receipt.

Partial Period or Pro Rated 2290 Tax

Form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. The current period begins July 1, and ends June 30, must be filed by the last day of the month following the month of first use, if you first use multiple vehicles in more than one month, then a separate Form 2290 must be filed for each month. When the first used month is later to then July pro rated tax is paid based on the first used month.

Support and Help Desk

Tax2290 help desk available to help you through the filing process at 866 - 245 - 3918 or write to us at support@taxexcise.com.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.