For current Simple customers

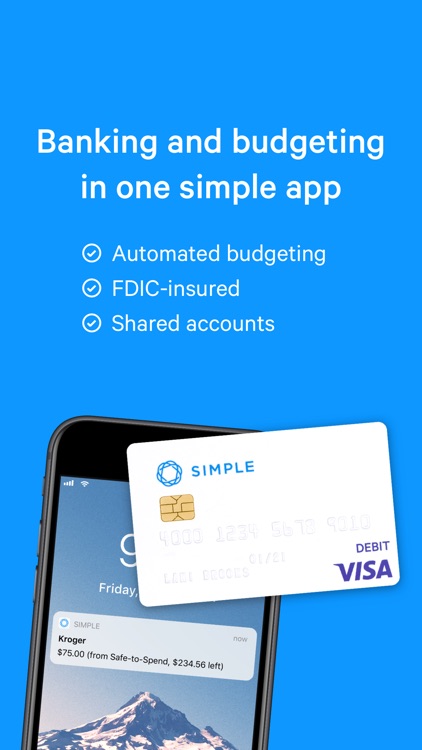

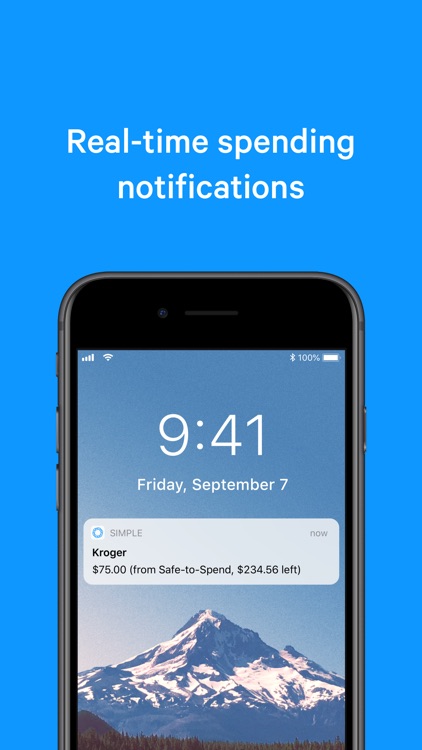

Simple - Mobile Banking

What is it about?

For current Simple customers

Simple supports Siri commands

App Screenshots

App Store Description

For current Simple customers

The mobile banking app for current customers of Simple. Please note that Simple is no longer opening new accounts, and existing accounts will be transitioned to BBVA USA in 2021. In the meantime, customers can still use the app as usual to bank, budget, and save.

Safe and secure online banking

Instant blocking for lost or stolen debit cards

FDIC insured accounts (up to the legal limit)

Built-in budgeting features

Expenses for automatic budgeting

Goals for super-easy saving

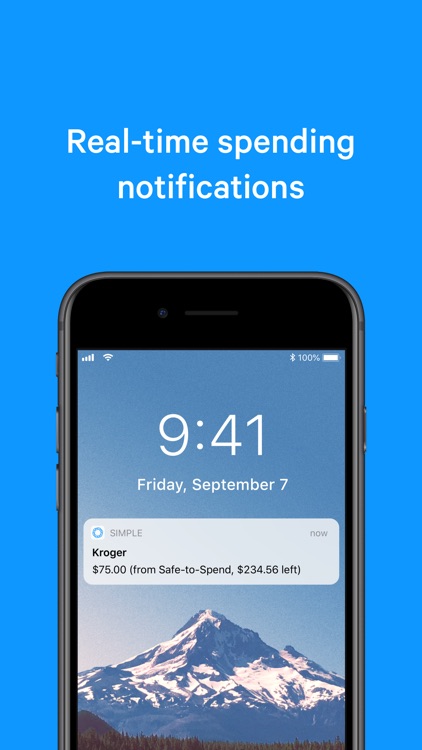

Safe to Spend® for confident spending

Convenient anytime, anyplace banking

Photo check deposit

Direct deposit

External account linking

Instant transfers to other Simple customers

Banking Services provided by BBVA USA, Member FDIC. The Simple Visa® Debit card is issued by BBVA USA pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.