Apple Pay is now officially available in the UK

Apple’s mobile payment service has crossed the pond.

Indeed, Apple Pay has been officially made available in the U.K., nine months after the original launch of the service in the U.S. and hours after its transatlantic arrival was accidentally tweeted by a British bank.

What’s Apple Pay again?

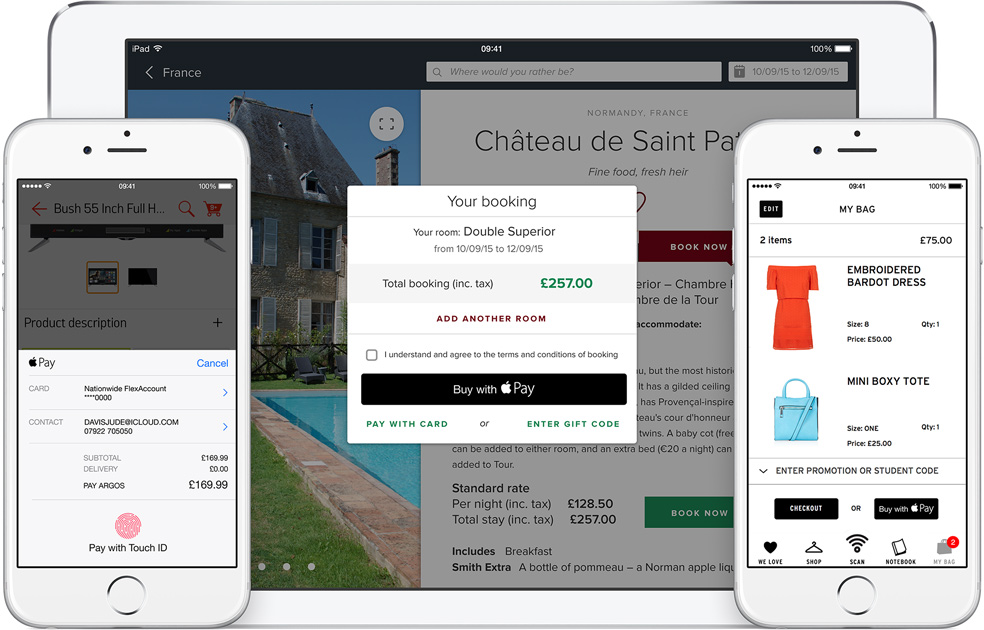

Apple Pay is a mobile payment system that allows users to make payments at contactless points of sale in shops using iPhone 6, iPhone 6 Plus, or Apple Watch, and in apps using a Touch ID-enabled iOS device like iPhone 6, iPhone 6 Plus, iPad Air 2, or iPad mini 3.

Announced alongside the iPhone 6 and the iPhone 6 Plus last September, Apple Pay was first launched in the U.S. in October. According to Apple CEO Tim Cook, it quickly became the largest mobile payment system yet as it accepted more than 1 million credit card registrations during its first three days of availability.

And now, Apple Pay has officially arrived in the U.K.

What banks support Apple Pay in the U.K.?

According to its U.K. website, Apple Pay works with credit and debit cards from a number of partner banks and financial institutions in the U.K. The service’s launch participants in the U.K. include American Express, MBNA, Nationwide, NatWest, Royal Bank of Scotland, Santander, and Ulster Bank.

Interestingly, the British bank that prematurely confirmed the launch of Apple Pay in the U.K., HSBC, is listed as one of the banks that are yet to support the service, along with Bank of Scotland, First Direct, Halifax, Lloyds Bank, M&S Bank, and TSB.

Where can I use Apple Pay in the U.K.?

As in the U.S., Apple Pay can be used in the U.K. when buying in brick-and-mortar locations or in apps.

At launch, Apple Pay is already supported in the following locations: Apple Store, Bill’s, Boots, BP, Costa, KFC, Le Pain Quotidien, Liberty, Lidl, M&S, McDonald’s, Nando’s, Post Office, Pret, Spar, Starbucks, Subway, The Co-operative Food, Transport for London, Wagamama, and Waitrose. It’s coming soon to Costcutter, Dune, Eat, Five Guys, JD, New Look, Screwfix, and Wilko.

As for apps, Apple Pay’s launch partners in the U.K. include Addison Lee, Apple Store, Babylon, Dice, Etsy, Five Guys, Hotel Tonight, JD, Just Eat, LastMinute.com, Miss Selfridge, Mr & Mrs Smith, Top10, Topman, Topshop, Uncover, Vueling, YPlan, Zalando, and Zara.

What’s the limit on Apple Pay transactions in the U.K., if any?

As reported last month, transactions made with Apple Pay are each limited to £20 only. But the cap, which is believed to have been implemented by U.K. banks because of instances of fraud on mobile payments, is expected to be increased to £30 in September.

U.S. banks, on the other hand, do not impose limits on Apple Pay transactions other than the normal restrictions placed on credit or debit cards.

What about Apple Pay in other countries?

With the service’s launch in the U.K. today, Apple Pay is apparently well into the process of rolling out to countries other than the U.S. It’s expected to be launched in Canada before the year is out, and there have been rumors of its probable, if not imminent, debut in such important markets as China, Africa, India, and the Middle East.

In any case, it’s worth noting that you can use Apple Pay at contactless points of sale in shops around the world so long as your cards are issued by Apple Pay’s partner banks and financial institutions in the U.S. and, as of today, the U.K.

Mentioned apps